Abstract

This paper provides a comprehensive analysis of the economic and political status of the Union of Comoros within the East African regional context. As a small island state strategically positioned in the Indian Ocean, Comoros occupies a distinctive position—geographically part of the Indian Ocean archipelagoes, politically a member of the African Union and the Arab League, and increasingly oriented toward East African economic integration. Drawing on recent data from the International Monetary Fund, African Development Bank, and contemporary political analysis, this paper examines Comoros’s macroeconomic trajectory, its ambitious infrastructure development agenda anchored by the “Comoros Emerging” plan, and the complex governance dynamics that shape its political landscape. The analysis reveals a country navigating significant structural vulnerabilities—historical political instability, climate vulnerability, and economic fragility—while pursuing strategic initiatives including the hosting of the 2026 Cap Business forum, port infrastructure development, and preparations for the 2027 Indian Ocean Island Games. The paper argues that Comoros’s status in East Africa is characterized by a fundamental tension between its aspirations for regional integration and economic emergence, and the persistent governance challenges and external vulnerabilities that constrain its developmental trajectory.

Keywords: Comoros, East Africa, Indian Ocean, regional integration, political economy, small island developing states, Azali Assoumani

1. Introduction

The Union of Comoros presents a distinctive case within the East African regional landscape. Comprising three main islands—Grande Comore, Anjouan, and Mohéli—this archipelago nation of approximately 867,000 people occupies a strategic position at the northern entrance of the Mozambique Channel . With a gross national income per capita of $1,690, Comoros falls within the lower-middle-income category by World Bank classification, yet its economic and political trajectory reflects the particular vulnerabilities and opportunities of small island developing states .

Comoros’s relationship with East Africa is complex and multi-layered. Geographically proximate to the East African coast, historically connected through Swahili trade networks, and a member of the African Union and its regional economic communities, the country nonetheless maintains distinct cultural, linguistic, and economic orientations that reflect its Arab, African, and French heritage. The country’s pursuit of the “Comoros Emerging” (Plan Comores Émergent—PCE) 2020-2030 vision represents an ambitious attempt to navigate these multiple identities while achieving structural economic transformation .

This paper examines Comoros’s contemporary status through four interconnected analytical dimensions. First, it analyzes the macroeconomic structure and performance, drawing on recent assessments from the International Monetary Fund and African Development Bank. Second, it examines the political landscape, including the governance dynamics following the disputed 2025 elections and the implications of President Azali Assoumani’s continued dominance. Third, it assesses the country’s regional integration strategy, including its hosting of the Cap Business 2026 forum and its participation in Indian Ocean and East African institutional frameworks. Fourth, it evaluates the infrastructure and investment landscape, including strategic port development and preparations for the 2027 Indian Ocean Island Games. The paper concludes by synthesizing these dimensions to assess Comoros’s evolving position within East Africa and the challenges and opportunities that lie ahead.

2. Macroeconomic Structure and Performance

2.1 Growth Trajectory and Structural Characteristics

The Comorian economy has historically exhibited a pattern of weak and volatile growth. According to the African Development Bank’s Country Diagnostic Note of September 2025, the average annual real GDP growth rate over the 1991-2023 period was below 2.5%, translating to per capita income growth of merely 0.3% per year . This anaemic performance reflects the compounding effects of political instability, inter-island conflicts, irregular electricity supply, climate shocks, and the COVID-19 pandemic’s disruptive impact.

Recent performance, however, suggests a modest acceleration. The International Monetary Fund, following its February 2026 review of Comoros under the extended credit facility arrangement, projects GDP growth of 4.1% for 2026, compared to an estimated 3.8% in 2025 . This positive trajectory, while welcome, must be contextualized against the low base from which it proceeds and the significant downside risks that persist.

The sectoral composition of Comorian GDP reflects the country’s stage of development and structural constraints. Over the 2001-2022 period, the tertiary sector—dominated by commerce and trade-related services—was the primary growth driver, contributing an average of 1.7 percentage points annually to economic growth . This predominance of services reflects both the importance of trade and distribution in a small island economy and the relatively underdeveloped state of productive sectors.

Agriculture, the second-largest contributor to growth at 0.6 percentage points annually, remains predominantly subsistence-oriented and characterized by low productivity . Key cash crops include vanilla, cloves, and ylang-ylang—products in which Comoros holds significant global market share but which are vulnerable to price volatility and climate impacts. The sector’s limited modernization constrains both rural incomes and the domestic resource base for agro-industrial development.

The secondary sector’s contribution—averaging just 0.3 percentage points annually—underscores the limited industrialization that has occurred . Manufacturing remains nascent, concentrated in simple processing activities and artisanal production. This structural pattern—a large services sector, modest agriculture, and minimal industry—reflects both the opportunities and constraints of the island economy and poses challenges for employment creation and value addition.

From the demand side, growth has been primarily driven by private consumption, sustained by substantial diaspora remittances . The Comorian diaspora, concentrated in France and other European countries, provides a critical financial flow that supports household consumption, finances imports, and contributes to external stability. However, reliance on remittances also creates vulnerability to economic conditions in host countries and does not necessarily build productive capacity domestically.

2.2 Fiscal Position and Public Finance

The fiscal position of the Comorian state reflects both the constraints of a small economy and the government’s developmental ambitions. The 2026 Finance Law, adopted unanimously by the National Assembly in December 2025, projects domestic revenue of 82.4 billion Comorian francs (approximately $186 million), an increase from 73.7 billion in 2025 . Total expenditures are budgeted at 142.7 billion francs, implying a significant financing gap to be covered by external resources.

The composition of budgeted expenditures reveals government priorities. Personnel costs (salaries and wages) account for 37.8 billion francs, representing a substantial portion of domestic revenue and reflecting the challenge of public sector wage bills common in small island states . Investments financed from domestic resources are projected at 13.3 billion francs, while externally financed public investments—channeled through the Public Investment Program—amount to nearly 50 billion francs . This heavy reliance on external financing for capital expenditure underscores both the importance of development partner relationships and the vulnerability to shifts in aid flows.

External support remains crucial for Comoros’s fiscal position. Budgetary aid is estimated at 9.5 billion francs for 2026, with donor grants for investment projects totaling 37.4 billion francs . The IMF’s approval of a $4.92 million disbursement in February 2026, part of a $43 million arrangement through 2027, provides additional balance of payments support and signals continued international engagement .

2.3 Monetary and External Sector Developments

Inflation dynamics have been relatively favorable in recent years. The IMF reports that inflation continued its downward trend in 2025, driven by declining import prices, leading to a revision of the 2025 inflation estimate from 3.8% to 3.5% . This moderation in price pressures provides some relief to household purchasing power and supports macroeconomic stability.

External reserves position appears robust by regional standards, with the IMF noting that international reserves were equivalent to eight months of imports in 2025 . This comfortable reserve position provides a buffer against external shocks and supports confidence in the currency’s peg to the euro—a monetary arrangement that provides stability but limits independent monetary policy.

The current account remains structurally dependent on diaspora remittances to offset persistent merchandise trade deficits. With a narrow export base concentrated in a few primary commodities and high import dependence for food, fuel, and manufactured goods, the trade deficit is structural rather than cyclical. Remittances, while substantial, represent household income transfers rather than export earnings, with different implications for long-term productive capacity.

3. Political Landscape and Governance Dynamics

3.1 The Azali Era and Political Consolidation

Contemporary Comorian politics is inseparable from the figure of President Azali Assoumani, a former army colonel who first came to power in a 1999 coup and has since dominated the political landscape through multiple terms. The political trajectory under Azali has been characterized by gradual consolidation of executive power, constitutional changes enabling extended tenure, and what observers characterize as increasing personalization of rule .

The 2025 elections, which returned Azali and his Convention pour le Renouveau des Comores (CRC) to power, were marked by opposition boycotts and disputes over electoral integrity. According to Africa Confidential’s analysis, “opposition parties largely excluded from government” following the polls, with many having “boycotted the elections in protest against Assoumani’s blocking of electoral reform” . This pattern of contested elections and opposition exclusion has become characteristic of Comorian politics, raising questions about democratic consolidation and political inclusivity.

Governance concerns extend beyond electoral processes to encompass broader institutional performance. The Millennium Challenge Corporation’s FY2026 scorecard for Comoros reveals mixed but concerning indicators across governance dimensions. The country scores in the 24th percentile for government effectiveness, the 31st percentile for rule of law, and the 49th percentile for control of corruption . These indicators suggest significant institutional weaknesses that affect both political legitimacy and the business environment.

3.2 Succession Questions and Political Stability

A recurring theme in contemporary Comorian politics is speculation about presidential succession and the potential for dynastic transfer of power. Africa Confidential reports that “opposition activism, including corporate boycotts and local protests and disruptions, has been reinforced by serial reports that Assoumani is trying to groom his son for the succession” . Such dynamics, if confirmed, would represent a significant evolution in the country’s political trajectory and potentially exacerbate tensions with opposition forces.

The succession question intersects with broader governance challenges, including the management of inter-island relations. Comoros’s constitutional architecture attempts to balance union-level authority with significant island autonomy—a structure designed to address historical tensions between Grande Comore, Anjouan, and Mohéli. Managing these federal dynamics requires careful political stewardship, particularly during periods of leadership transition.

3.3 Recent Governance Developments: Media Freedom Legislation

Amidst concerns about political space, the December 2025 adoption of a revised Information and Communication Code represents a noteworthy governance development. The National Assembly approved amendments to the code following debate that prominently featured tensions between government positions and journalist concerns regarding source protection .

The debate centered on proposed language that would have required journalists to disclose sources “except by reasoned judicial decision, in exceptional cases provided for by law.” Journalists argued that such an exception “compromises obtaining information from the source and consequently investigative journalism that could endanger the source” . Following parliamentary deliberation, the Assembly amended the article to state simply: “The journalist is not required to disclose his sources of information. To this end, he cannot be bothered by the public authority” .

This legislative outcome suggests that parliamentary processes can produce protections for media freedom even in a constrained political environment. However, the gap between legal provisions and practical implementation—and the broader context of political space restrictions—means that the code’s impact on actual media practice remains to be seen.

3.4 External Perceptions and Partner Engagement

International partners continue to engage with Comoros while expressing concerns about governance trajectories. The IMF’s February 2026 assessment, while positive on economic performance, acknowledged that “downside risks remain significant, reflecting Comoros’s persistent fragility and elevated global uncertainty” . Deputy Managing Director Nigel Clarke’s formulation—acknowledging “broadly satisfactory” performance while noting fragility—captures the nuanced stance of international financial institutions.

The Millennium Challenge Corporation’s scorecard methodology provides another window into external perceptions. Comoros passes on approximately half of the indicators, with particular strengths in areas such as workforce development (94th percentile), child health (80th percentile), and freedom of information (77th percentile) . However, weaknesses in rule of law, regulatory quality, and control of corruption affect eligibility for certain forms of assistance and signal concerns to potential investors .

4. Regional Integration and Diplomatic Positioning

4.1 Hosting Cap Business 2026: Strategic Economic Diplomacy

A landmark event in Comoros’s regional positioning is the hosting of the 15th edition of the Indian Ocean Islands Business Forum, Cap Business, scheduled for April 27-29, 2026, in Moroni . This forum, which brings together economic actors from Comoros, Réunion, Seychelles, and Madagascar, represents a significant opportunity for the country to project itself as a hub for regional economic cooperation.

Minister of Economy Moustoifa Hassani Mohamed framed the event as positioning the country “at the heart of regional and international economic dynamics” and reflecting “recognition of the growing role of Comoros in regional economic integration and inclusive development of the Indian Ocean space” . The forum’s objectives include strengthening foreign direct investment attraction, encouraging public-private partnerships, reinforcing regional value chains, and facilitating exchanges between states, private sector actors, financial institutions, and development partners .

The sectors prioritized for the forum—agriculture and agro-industry, blue economy and sustainable fisheries, renewable energy, tourism, infrastructure and logistics, industrial transformation, and small and medium enterprises—align closely with Comoros’s stated development priorities under the Plan Comores Émergent . The involvement of multiple institutional partners, including the Union of Chambers of Commerce (UCCIA), the new employers’ organization OPACO, and the French Development Agency (AFD), demonstrates the multi-partner approach to regional economic cooperation.

Hamidou Mhoma of UCCIA articulated the forum’s significance succinctly: “Cap Business will be a means to sell our country, to demonstrate investment opportunities and to make known our Plan Comores Emergent” . This formulation captures the dual function of such events—both practical business promotion and broader national branding and positioning.

4.2 Participation in Continental Fora

President Azali Assoumani’s attendance at the 39th African Union Summit in Addis Ababa in February 2026 reflects continued engagement with continental political processes . The summit agenda—addressing peace and security, regional integration, sustainable development, and implementation of AU initiatives—provides opportunities for Comoros to articulate its interests and build diplomatic capital.

The summit’s coincidence with the Italy-Africa Summit, also held in Addis Ababa, offered additional opportunities for engagement with European partners on trade, investment, development cooperation, and regional security . For a country with deep historical ties to France and significant diaspora presence in Europe, such engagement remains strategically important.

4.3 The Question of East African Community Membership

A significant dimension of Comoros’s regional positioning is the question of potential membership in the East African Community (EAC). While Comoros is not currently an EAC member, its geographic location, historical trading connections with the East African coast, and membership in other regional organizations make the question of eventual membership relevant.

The EAC’s expansion trajectory—including admission of the Democratic Republic of Congo in 2022 and ongoing consideration of other applicants—suggests that the Community remains open to new members that meet its criteria and contribute to regional integration objectives. For Comoros, EAC membership would offer access to a larger market, participation in regional infrastructure initiatives, and deeper integration with fast-growing East African economies. However, it would also require alignment with EAC policies and standards, potentially challenging existing trade and investment patterns oriented toward Europe and the Indian Ocean.

The hosting of Cap Business 2026, focused on Indian Ocean regional cooperation, does not preclude simultaneous exploration of East African integration. Indeed, Comoros’s position as a bridge between East Africa and the Indian Ocean islands could be articulated as a strategic asset—a role that leverages multiple regional memberships to facilitate trade and investment flows.

4.4 Indian Ocean Regional Cooperation

Beyond continental engagement, Comoros maintains active participation in Indian Ocean regional organizations, including the Indian Ocean Commission (IOC) and the Indian Ocean Rim Association (IORA). These memberships reflect the country’s identity as an island state with shared interests in maritime security, sustainable ocean economy, and climate resilience with other Indian Ocean nations.

The Cap Business forum, focused specifically on the Indian Ocean islands, represents a concrete manifestation of this regional cooperation framework . The regular convening of economic actors from Comoros, Réunion, Seychelles, and Madagascar builds practical cooperation that complements higher-level political dialogue and creates networks that facilitate trade and investment.

5. Infrastructure Development and Investment Landscape

5.1 Strategic Port Development: Boingoma Project

Among the most significant infrastructure initiatives underway in Comoros is the expansion of the port of Boingoma on Mohéli island, part of the broader maritime interconnectivity project. As of late 2025, the project had achieved approximately 40% overall progress, with Egyptian construction firm Arabcontractor on site and beginning rock extraction for port works .

The project’s significance extends beyond the physical infrastructure. Djinti Ahamada, Secretary General of the Ministry of Maritime and Air Transport, emphasized the complexity: “A port is not like building a school. It requires patience, energy and above all technical expertise, which is not always available locally. We often call on foreign experts to support the project” . This acknowledgment of technical capacity constraints highlights the importance of international partnerships in implementing strategic infrastructure.

The Boingoma port development is designed to improve inter-island connectivity and facilitate commerce between the Comorian islands, while also strengthening overall port infrastructure . For an archipelago nation, maritime connectivity is not merely an economic convenience but a fundamental requirement for national integration and economic cohesion. Improved port infrastructure reduces transportation costs, facilitates trade, and supports tourism development—all critical for diversified economic growth.

5.2 Preparations for the Indian Ocean Island Games (JIOI) 2027

A major catalyst for infrastructure investment is Comoros’s role as host of the Indian Ocean Island Games (Jeux des Îles de l’Océan Indien—JIOI) in 2027. The 2026 Finance Law explicitly prioritizes “mobilization of infrastructure dedicated to the games,” signaling government commitment to leveraging the event for broader infrastructure development .

The JIOI represents both an opportunity and a challenge. Successfully hosting a multi-sport regional event requires significant investment in sports facilities, accommodation, transportation, and related infrastructure. These investments, if well-planned and executed, can leave lasting legacies that support tourism development, improve urban amenities, and enhance quality of life. However, the experience of other small island states hosting similar events suggests risks of cost overruns, underutilized facilities, and debt accumulation.

The games also offer soft power benefits—an opportunity to showcase Comoros to regional audiences, demonstrate organizational capacity, and build national pride. The visibility associated with hosting can support tourism promotion and investment attraction if effectively leveraged.

5.3 Energy Sector Development

Energy infrastructure represents a critical constraint and priority for Comoros’s development. The African Development Bank’s diagnostic note identifies “irregularity in electricity supply” as a significant constraint on growth . Unreliable and expensive power undermines business competitiveness, constrains industrial development, and affects quality of life.

The 2026 Finance Law identifies “development of the energy sector” as a government priority, alongside cost-of-living measures and infrastructure development . While specific projects are not detailed in available sources, the emphasis suggests continued attention to addressing this binding constraint through investments in generation, transmission, and distribution infrastructure.

Given Comoros’s geography and natural resource endowment, renewable energy sources—particularly solar and potentially geothermal—offer opportunities to reduce dependence on imported fossil fuels, improve energy security, and align with climate objectives. Development partner engagement in the energy sector, including potential support through mechanisms like the African Development Bank’s sustainable energy funds, could accelerate progress.

5.4 Investment Climate Assessment

The investment climate in Comoros presents a mixed picture. The Millennium Challenge Corporation’s FY2026 scorecard provides quantitative indicators across multiple dimensions relevant to investors. Comoros performs relatively well on business start-up procedures (70th percentile), trade policy (55th percentile), and workforce development (94th percentile) .

However, significant weaknesses appear in areas critical for sustained private sector development. Access to credit scores in the 40th percentile, reflecting limited financial intermediation and collateral constraints . Property and land rights score in the 29th percentile, indicating challenges in secure tenure and land registration that affect both investment and household welfare . Regulatory quality similarly scores in the 29th percentile, suggesting that the business regulatory environment imposes costs and uncertainties on enterprises .

The Cap Business 2026 forum represents an effort to address these perceptions by showcasing opportunities directly to potential investors and facilitating connections between Comorian and regional businesses . The emphasis on public-private partnerships in the forum’s agenda suggests recognition that private investment will need to complement public resources in achieving development objectives.

6. Challenges and Vulnerabilities

6.1 Structural Economic Constraints

Despite recent positive developments, Comoros confronts profound structural economic challenges. The African Development Bank’s diagnostic note emphasizes that growth has historically been “weak and volatile,” reflecting fundamental constraints that persist . Agricultural productivity remains low, limiting rural incomes and food security. Industrial development is minimal, constraining employment creation and value addition. Infrastructure deficits—in energy, transport, and digital connectivity—raise costs and limit competitiveness.

The small size of the domestic market, combined with remoteness from major markets, creates inherent disadvantages for many types of economic activity. Achieving economies of scale sufficient for efficient production often requires access to regional or global markets—access that depends on both physical connectivity and trade facilitation.

Human capital constraints compound these structural challenges. While the MCC scorecard indicates relatively strong performance on workforce development indicators , the historical impact of political instability and underinvestment on education and health systems limits the skilled workforce available for economic transformation.

6.2 Climate Vulnerability and Environmental Pressures

As a small island state, Comoros is acutely vulnerable to climate change impacts, including sea-level rise, increased cyclone intensity, and changing rainfall patterns. The African Development Bank notes “climate shocks” among factors contributing to growth volatility , while Africa Confidential highlights “harsher economic conditions in Comoros, partly driven by climate change and cyclone-related power disruptions” as threats to political stability .

Climate vulnerability has both immediate and long-term dimensions. In the short term, extreme weather events can destroy infrastructure, disrupt economic activity, and impose fiscal costs. Over the longer term, gradual changes in temperature and precipitation patterns affect agricultural viability, water availability, and coastal zone stability. For an economy heavily dependent on agriculture and tourism, these impacts are existential.

Adaptation to climate change requires significant investment in resilient infrastructure, coastal protection, water management, and agricultural diversification—investments that compete with other priorities for limited fiscal resources. International climate finance, accessed through mechanisms like the Green Climate Fund, represents a critical resource for addressing these challenges.

6.3 Political and Governance Risks

The political landscape presents ongoing risks to stability and development. The contested nature of recent elections, opposition exclusion from governance, and concerns about succession dynamics create uncertainty that affects both domestic confidence and international perceptions . Governance indicators revealing weaknesses in rule of law, government effectiveness, and corruption control suggest that institutional capacity to manage these political dynamics constructively remains limited.

The relationship between political stability and economic development is mutually reinforcing—stability supports investment and growth, while growth provides resources for addressing grievances and maintaining legitimacy. Conversely, political tensions can undermine economic performance, creating downward spirals that are difficult to escape. Managing this relationship effectively requires political leadership committed to inclusive governance and institutional strengthening.

6.4 External Vulnerabilities

As a small, open economy, Comoros remains highly vulnerable to external shocks beyond its control. Global commodity price fluctuations affect the value of vanilla, clove, and ylang-ylang exports, while also influencing import costs for food and fuel. Economic conditions in Europe affect both diaspora remittances and tourism demand. Global financial conditions influence access to capital and the cost of borrowing.

The IMF’s acknowledgment that “downside risks remain significant, reflecting Comoros’s persistent fragility and elevated global uncertainty” captures this vulnerability. For a country with limited diversification and narrow export base, resilience to external shocks depends on maintaining adequate reserve buffers, fiscal space, and policy flexibility—all challenging in the context of structural constraints.

7. Opportunities and Future Trajectories

7.1 Leveraging Regional Events for Development Impact

The convergence of major regional events—Cap Business 2026 and the Indian Ocean Island Games 2027—offers a window of opportunity for accelerated infrastructure development and international visibility. The government’s explicit prioritization of JIOI-related infrastructure in the 2026 budget signals intention to leverage these events for lasting developmental impact.

Realizing this potential requires careful planning to ensure that investments serve post-event needs, not merely temporary requirements. Sports facilities should be designed for multi-purpose use and community access. Accommodation investments should support the broader tourism development strategy. Transportation improvements should address permanent connectivity needs. The experience of other host countries suggests that event preparation can catalyze investment that might otherwise be delayed, but only if aligned with long-term development priorities.

7.2 Blue Economy Potential

Comoros’s maritime territory vastly exceeds its land area, positioning the blue economy as a strategic development opportunity. The prioritization of “blue economy and sustainable fisheries” in the Cap Business 2026 agenda reflects recognition of this potential. Sustainable fisheries, marine tourism, port services, and potentially maritime transport and logistics all offer avenues for economic diversification and employment creation.

Realizing blue economy potential requires investment in sustainable resource management, port infrastructure (as with the Boingoma project), and human capital for maritime industries. It also requires regional cooperation on maritime security, fisheries management, and ocean governance—areas where Comoros’s participation in Indian Ocean regional organizations provides frameworks for collaboration.

7.3 Deepening Regional Integration

The trajectory of regional integration—both within the Indian Ocean space and potentially with East Africa—offers opportunities for market expansion, investment attraction, and policy learning. Comoros’s position at the intersection of these regional frameworks could be articulated as a strategic asset: a bridge between East African dynamism and Indian Ocean island economies.

The hosting of Cap Business 2026 provides a platform for advancing this positioning, demonstrating Comoros’s capacity to convene regional economic actors and facilitate cross-border business relationships . Sustained engagement with both Indian Ocean and East African regional institutions, combined with domestic reforms to improve the investment climate, could progressively deepen integration and its development benefits.

7.4 Diaspora Engagement

The Comorian diaspora represents a significant asset that remains underutilized for development purposes. Remittances already provide critical financial flows supporting household consumption and external stability . However, diaspora contributions to investment, skills transfer, and market access could be substantially expanded through deliberate engagement strategies.

Initiatives to facilitate diaspora investment, whether through dedicated investment vehicles, matching grant programs, or technical support for returnee entrepreneurs, could channel diaspora resources toward productive activities. Diaspora knowledge networks could support skills development and technology transfer. Diaspora advocacy could strengthen Comoros’s international positioning and market access.

8. Conclusion: Comoros’s Evolving Status in East Africa

Comoros’s economic and political status in East Africa reflects the complex positioning of a small island state navigating multiple regional identities, structural vulnerabilities, and developmental aspirations. Economically, the country is pursuing a trajectory of modest acceleration—with projected 4.1% growth in 2026, inflation moderation, and comfortable reserve buffers—while confronting deep-seated structural constraints including limited productive diversification, infrastructure deficits, and climate vulnerability.

Politically, Comoros under President Azali Assoumani presents a picture of consolidation and continuity, with the ruling CRC dominating government following disputed 2025 elections. Governance indicators reveal institutional weaknesses across rule of law, government effectiveness, and corruption control dimensions, while succession speculation adds uncertainty to the political horizon. The December 2025 adoption of strengthened media freedom protections offers a counter-narrative of institutional progress, though implementation remains to be tested.

Regionally, Comoros is actively pursuing integration and visibility through multiple channels. The hosting of Cap Business 2026 positions the country as a convenor of Indian Ocean economic cooperation. Participation in African Union processes maintains continental engagement. Preparations for the 2027 Indian Ocean Island Games catalyze infrastructure investment and offer soft power benefits. The question of potential East African Community membership remains open, representing both opportunity and strategic choice.

Infrastructure development—including the Boingoma port expansion, energy sector investments, and JIOI-related facilities—addresses critical constraints while demonstrating capacity to implement complex projects with international partnerships. The investment climate, while showing strengths in some dimensions, requires continued attention to regulatory quality, property rights, and access to credit to attract and sustain private investment.

The picture that emerges is one of a country in transition—moving from a history of political instability and weak growth toward a more stable and prosperous trajectory, yet still confronting the deep fragilities that characterize small island developing states. Comoros’s status in East Africa is not yet that of a dynamic regional hub or major economic partner for continental powers. But it is increasingly that of an active regional participant, leveraging its strategic location, diaspora connections, and developmental ambitions to carve out a distinctive role in the Indian Ocean-East African interface.

The coming years will test whether the promising developments of 2025-2026—the macroeconomic stabilization, the infrastructure investments, the regional event hosting—can be sustained and translated into tangible improvements in living standards for Comorians. Success will require continued policy discipline, effective implementation of investment projects, skillful navigation of political transitions, and sustained engagement with regional partners. The foundations are being laid; the superstructure remains to be built.

References

-

African Development Bank. “Comoros – Country Diagnostic Note – September 2025.” February 2026.

-

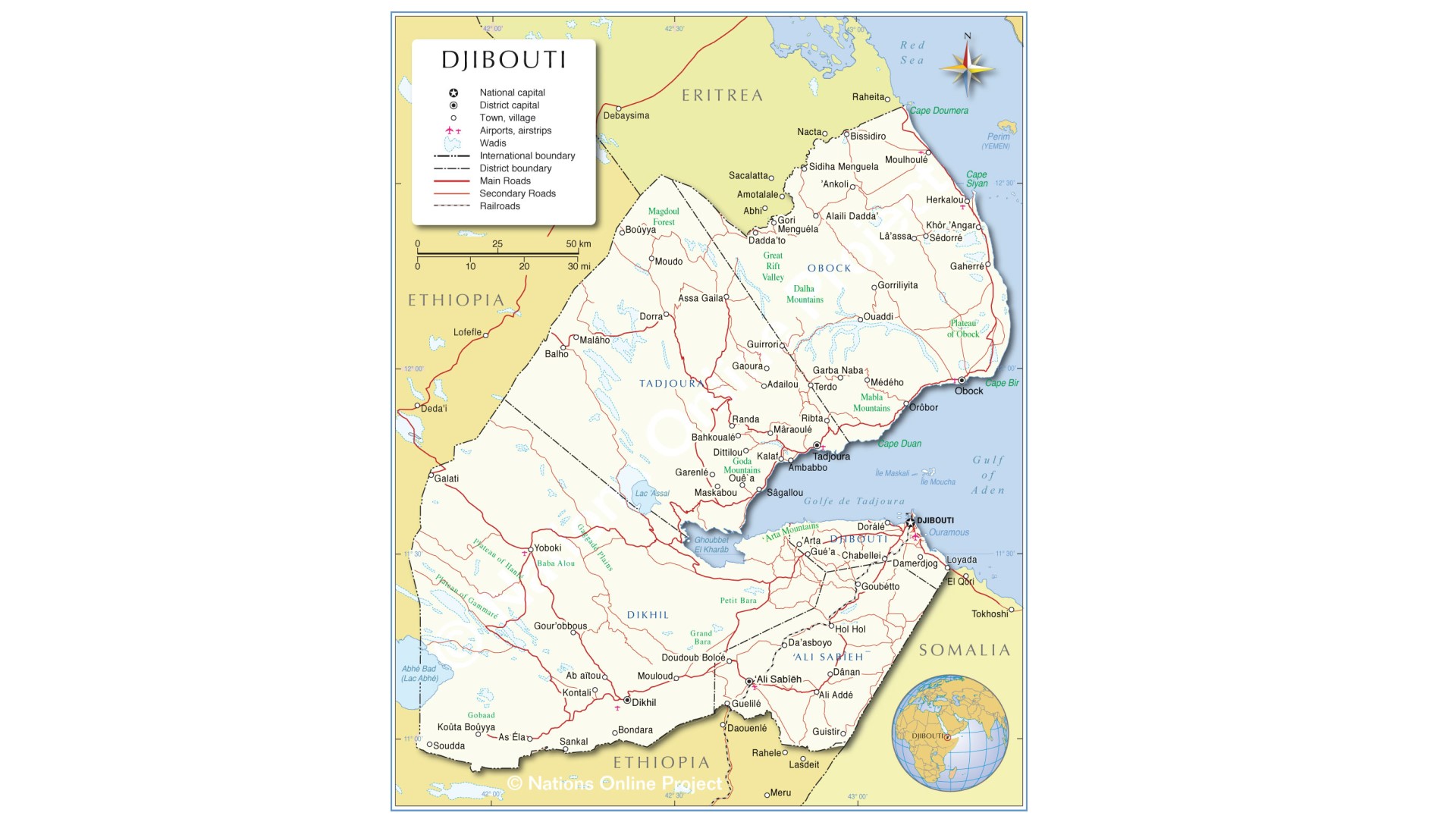

Africa Confidential. “Economic ructions shake personal rule in Comoros and Djibouti.” Vol. 66, No. 4, February 2026.

-

Al Watwan. “National Assembly I 2026 Finance Bill Unanimously Adopted.” December 28, 2025.

-

Al Watwan. “Cap Business 2026: Comoros to Host 15th Edition Next April.” January 19, 2026.

-

Millennium Challenge Corporation. “Comoros Scorecard, FY 2026.” United States Government.

-

Africa Confidential. “East Africa News by Category.” January 2026.

-

Africa Press Comores. “Maritime Interconnectivity: Progress on Boingoma Port.” November 26, 2025.

-

Market Publishers. “Comoros: Country Business Profile 2026.” BAC Reports, February 2026.

-

Agência de Notícias Brasil-Árabe. “Comoros’ Economy Expected to Grow 4.1%.” February 11, 2026.

-

Fana Media Corporation. “President of Comoros Arrives in Addis Ababa Ahead of 39th AU Summit.” February 11, 2026.