Abstract

This paper provides a comprehensive analysis of Mauritius’s contemporary economic and political status within the East African region and its broader Indian Ocean context. Drawing on sovereign credit assessments, official government policy statements, geopolitical analysis, and human rights monitoring, it argues that Mauritius occupies a paradoxical position as both a “development focused state” and a state whose democratic credentials face subtle but significant accountability tests. Economically, Mauritius demonstrates remarkable resilience with GDP per capita exceeding $11,500, comfortable foreign exchange reserves equivalent to 13 months of imports, and a diversified services-driven economy, yet confronts structural vulnerabilities including youth unemployment (20 percent), income inequality (Gini coefficient of 37), and climate change exposure . Politically, the October 2024 elections produced a decisive democratic alternation, with Navin Ramgoolam’s Alliance du Changement securing 60 of 70 parliamentary seats in a peaceful transition that reaffirmed institutional stability . Geopolitically, Mauritius navigates intensified great-power competition in the Indian Ocean, maintaining balanced relationships with India (its “special and historic” partner), China (its largest Asian trade partner), France (its former colonial power), and the United States (its key trade partner under AGOA), while simultaneously pursuing a landmark sovereignty achievement—the impending return of the Chagos Archipelago under a 99-year lease arrangement with the United Kingdom . Regionally, Mauritius positions itself as a gateway for investment into Africa, hosting the 18th US-Africa Business Summit in 2026 and chairing the Indian Ocean Rim Association . However, this impressive external positioning coexists with a troubling silence before the African Commission on Human and Peoples’ Rights, raising questions about the depth of its commitment to African accountability mechanisms . Mauritius’s status is thus defined by the tension between global recognition as a development success story and the imperative to substantiate its democratic narrative through consistent engagement with continental institutions.

1. Introduction: The “Star and Key” of the Indian Ocean

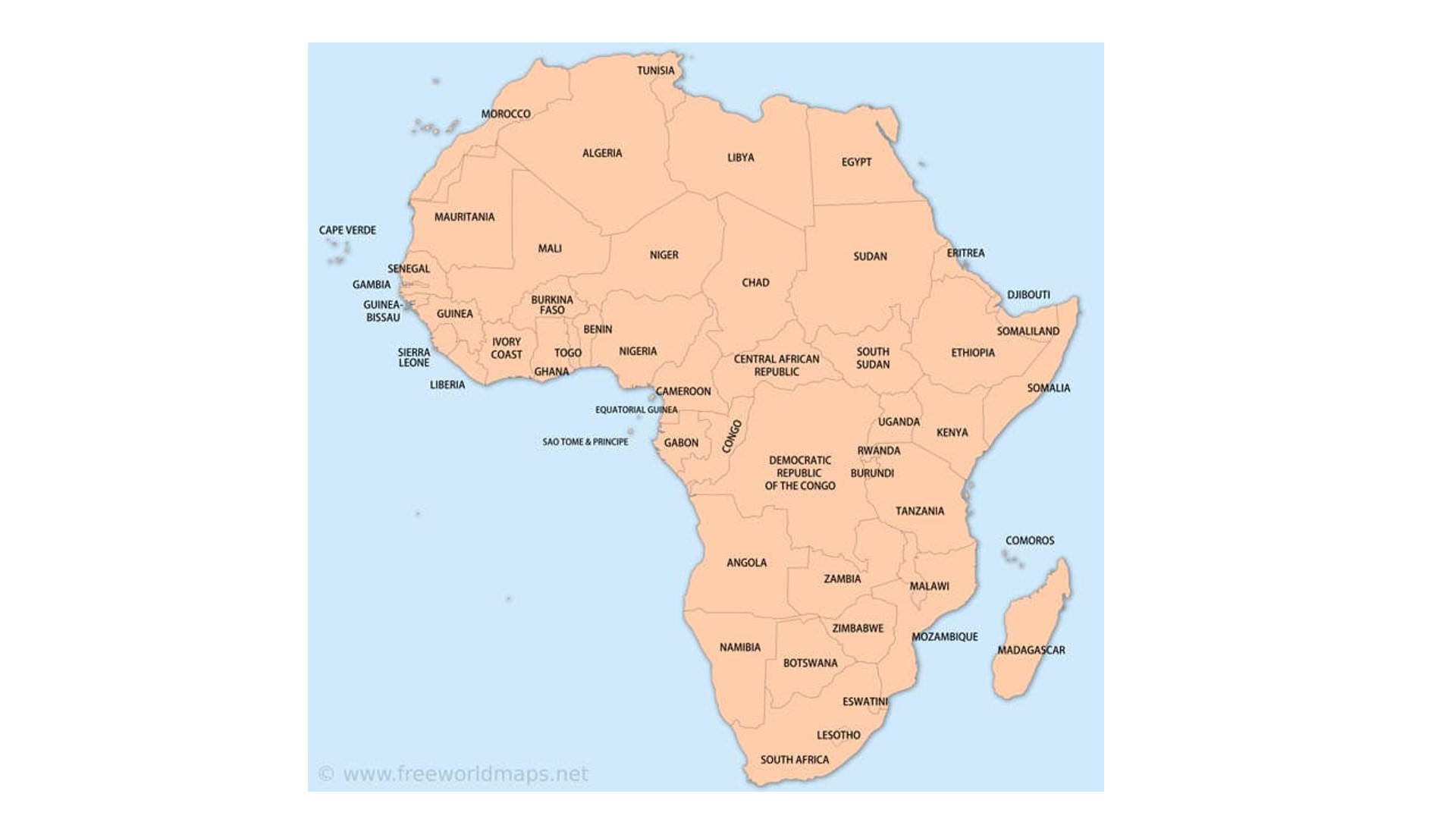

Mauritius, known poetically as the “Star and Key of the Indian Ocean,” occupies a unique position in the African landscape. With a territory of just 2,040 square kilometers and a population below 1.3 million, it is among Africa’s smallest states by both measures . Yet its international influence and economic weight far exceed its geographic dimensions. Located approximately 2,000 kilometers off Africa’s southeastern coast, east of Madagascar, Mauritius sits astride the major sea lanes connecting Asia, Africa, and the Middle East—sea lanes that carry over half the world’s container traffic and one-third of global maritime trade .

Since independence in 1968, Mauritius has charted a distinctive development trajectory. From an economy initially dependent on sugar cultivation, with per capita income below $300, it has transformed into an upper-middle-income country with GDP per capita exceeding $11,500—among the highest in Africa . This transformation, often termed the “Mauritian Miracle” or “development典范” (development model) in Chinese analyses, rests on political stability, institutional continuity, and successive waves of economic diversification: from sugar to textiles in the 1980s, to tourism and financial services in the 1990s, and most recently to information technology, global business services, and the blue economy .

However, Mauritius’s status is not merely economic. It is simultaneously an arena of intensified great-power competition, a territorial claimant pursuing final decolonization, a regional hub for African investment, and a state whose democratic narrative faces scrutiny from continental human rights mechanisms. This paper contends that Mauritius’s contemporary status is best understood through four interconnected lenses: its resilient yet structurally constrained economy; its stable democratic polity marked by recent peaceful alternation; its sophisticated geopolitical positioning amid Indian Ocean rivalries; and its paradoxical relationship with African continental institutions. The interplay between these domains defines Mauritius as a state whose achievements are substantial yet whose accountability—particularly to African mechanisms—remains a work in progress.

2. Economic Status: Resilience, Diversification, and Structural Constraints

2.1 Macroeconomic Fundamentals and Growth Trajectory

Mauritius’s economy enters 2026 in a phase of moderated growth following the post-pandemic tourism surge. According to Coface risk assessments, GDP growth is projected at 3.5 percent in 2026, a slight acceleration from 3 percent in 2025 but below the 4.9 percent recorded in 2024 . This moderation reflects normalization in tourism sector expansion after the strong rebound of 2022–2024, when arrivals recovered to pre-COVID levels.

The services sector dominates economic activity, contributing approximately 77 percent of GDP in 2024 . Within services, financial and insurance activities, information and communication technology, and tourism-related services (accommodation, food, and transportation) are primary drivers. The Global Economic Diversification Index ranks Mauritius highly, with a PCA Average of 99.01 in 2026, significantly above regional peers including Kenya (94.73), Botswana (95.07), and South Africa (103.26) . This ranking reflects the economy’s successful transition from reliance on sugar and textiles to a diversified base.

Inflation remains contained within the central bank’s 2–5 percent target range, projected at 3.6 percent for 2026 . This stability stems from moderating global commodity prices, particularly for food and energy imports, and prudent monetary policy. The Bank of Mauritius raised its key rate to 4.5 percent in February 2025 in response to services and wage pressures but is expected to maintain rates through 2026 absent external shocks .

2.2 Fiscal Architecture: Consolidation After Expansion

The fiscal position reflects a sharp policy pivot. The 2024–2025 budget was expansionary, featuring tax incentives and substantial subsidies, resulting in a deficit of nearly 10 percent of GDP—the highest since the COVID-19 years . The 2025–2026 budget marks a restrictive turn: rationalization of VAT exemptions, increased excise taxes on harmful products and vehicles, and higher contributions from high-income households and corporations .

Public debt remains above the self-imposed statutory ceiling of 80 percent of GDP, projected at 87 percent in 2026 . However, the debt profile is favorable: less than one-quarter is external, and domestic borrowing from the well-developed local financial market limits currency risk. Foreign exchange reserves stand at a robust $9.5 billion as of October 2025, equivalent to 13 months of import cover—a substantial buffer against external shocks .

The government’s fiscal consolidation strategy includes progressive increases in the retirement age from 60 to 65 years, rationalization of social benefits, and improved tax collection. These measures, while fiscally necessary, face implementation challenges due to their unpopularity with affected constituencies .

2.3 Sectoral Dynamics: Strengths and Vulnerabilities

Tourism remains a cornerstone, contributing approximately 22 percent of GDP in 2024 . Arrivals have normalized after the post-pandemic surge, supporting accommodation, food services, retail trade, and transportation. The Mauritius Tourism Promotion Authority is actively diversifying source markets, with a strategic focus on India’s Tier-2 and Tier-3 cities, aiming to capture growing demand from beyond metropolitan centers . Visa-on-arrival facilities and expanded air connectivity—including nonstop flights from multiple Indian hubs—support this strategy . However, tourism dependence creates vulnerability: the sector’s 22 percent GDP share means any prolonged disruption—from global recessions, health crises, or climate events—would have outsized economic impacts.

Financial services constitute the second pillar, with Mauritius maintaining its position as a premier jurisdiction for investment into Africa and Asia. Double taxation treaties with India, China, and numerous African countries, combined with an English-French bilingual workforce and common law legal system, attract global financial institutions. The sector benefits from political stability, regulatory credibility, and sophisticated professional services.

Manufacturing, particularly textiles and apparel (17 percent of exports in 2024), faces structural headwinds . Intensified competition from Asian economies with lower labor costs, rising domestic production costs, and U.S. tariffs (15 percent) constrain growth prospects. Stagnation in this sector underscores the need for continuous upgrading toward higher value-added segments.

Agro-industry, historically dominated by sugar (13 percent of exports), is undergoing strategic transformation . The 2025–2026 budget announced a historic shift in food strategy, with the goal of reducing the Rs 65 billion food import bill by increasing domestic production from 25 percent to higher levels . Incentives include Rs 35,000 per ton for sugar (up to 60 tons), free land preparation funded at Rs 65,000 per acre, and support for smart agriculture and sheltered farming inspired by Greek, Israeli, and Dutch models .

Blue economy emerges as a strategic frontier. Following the integration of Chagos waters and dissolution of the Joint Fisheries Management Area, Mauritius now exercises sole control over expanded maritime zones . Initiatives include supporting fishers’ transition from artisanal to semi-industrial operations (Rs 200,000 grants for lagoon license surrender), developing Agalega as a fish landing hub with cold storage and rapid export airlinks, and exploring carbon credits from Saya de Malha’s marine grasslands .

2.4 Structural Constraints and Social Challenges

Despite these strengths, structural constraints persist. Youth unemployment remains elevated at 20 percent for the 16–24 age group in Q2 2025 . This reflects skills mismatches between educational outputs and labor market demands, as well as the informal sector’s prevalence in traditional activities.

Income inequality is significant, with a Gini coefficient of 37 in 2023 . Low female labor force participation (47 percent) contributes to persistent disparities, as do productivity gaps between high-value services and traditional agriculture/textile sectors.

Climate vulnerability poses existential risk. As a small island state, Mauritius faces intensifying tropical cyclones, prolonged droughts, sea-level rise, and coastal erosion . The 2020 Wakashio oil spill highlighted ecological fragility and the catastrophic potential of maritime accidents . The government’s climate resilience agenda, including marine protected areas and mangrove restoration, is essential but requires sustained investment .

Skills shortages constrain diversification into higher value-added activities. While bilingualism (English and French) provides advantages, shortages in ICT, engineering, and financial analytics limit competitiveness .

3. Political Status: Democratic Alternation and Institutional Continuity

3.1 The October 2024 Elections: A Decisive Mandate

Mauritius’s democratic credentials were reaffirmed in the October 2024 legislative elections. Incumbent Prime Minister Pravind Jugnauth and his allies suffered a resounding defeat after a campaign marred by a large-scale wiretapping scandal . Navin Ramgoolam’s Alliance du Changement secured 60 of 70 parliamentary seats, a landslide victory that reflected both voter repudiation of the previous administration and confidence in the opposition’s alternative vision .

The peaceful alternation demonstrated, once again, the robustness of Mauritian democratic institutions. Jugnauth’s prompt concession of defeat and orderly transition of power underscored the institutionalization of electoral competition and the military’s continued subordination to civilian authority. This contrasts sharply with democratic backsliding observed elsewhere in the region and reinforces Mauritius’s status as a stable outlier in African governance rankings.

3.2 The Ramgoolam Administration: Policy Direction and International Engagement

Prime Minister Ramgoolam, previously holding office on two occasions, brings extensive governing experience. His administration’s policy priorities, articulated in the Government Programme 2025–2029 and aligned with the long-term Vision 2050, emphasize economic diplomacy, sustainable growth, climate resilience, and strategic partnerships .

The foreign policy agenda is ambitious. Mauritius will host the Indian Ocean Conference in April 2026, convening heads of state and government from Indian Ocean Rim countries to address maritime security, fisheries management, and renewable energy cooperation . The 18th US-Africa Business Summit, expected to attract 3,000 delegates, will position Mauritius as a premier gateway for sustainable investment into Africa .

Bilateral relations with India remain “special and historic,” anchored in shared history, cultural ties, and people-to-people connections . Prime Minister Modi and Prime Minister Ramgoolam have reviewed Enhanced Strategic Partnership progress, with India committing a Special Economic Package supporting infrastructure, employment, and healthcare—including a 500-bed hospital, AYUSH Centre of Excellence, and veterinary school . This partnership extends to maritime security, with both nations affirming commitment to peace and stability in the Indian Ocean Region under India’s Vision MAHASAGAR .

3.3 The Chagos Archipelago: Sovereignty and Decolonization

The Chagos Archipelago represents Mauritius’s longest-standing sovereignty dispute and a defining feature of its international posture. Located approximately 750 kilometers northeast of the main island, the archipelago was excised from Mauritius by the United Kingdom in 1965, prior to independence, to establish the British Indian Ocean Territory. The main island, Diego Garcia, was leased to the United States for construction of a strategic military base that has supported operations including the Gulf and Iraq wars .

In May 2025, after decades of diplomatic and legal advocacy, Mauritius and the United Kingdom signed a treaty providing for sovereignty restitution . Under the agreement, the UK recognizes Mauritian sovereignty over the archipelago while retaining access to Diego Garcia under a 99-year lease, with estimated total payments of $4.7 billion . Implementation is scheduled for early 2026, contingent on UK parliamentary approval—though the House of Lords has signaled potential obstacles .

The sovereignty achievement carries profound significance. It completes the unfinished business of decolonization, restores territorial integrity, and opens new maritime zones for economic exploitation. As the Minister of Agro-Industry noted, the dissolution of the Joint Fisheries Management Area means Mauritius now exercises sole control over migratory fishing rights in these waters . However, geopolitical complexities persist: some Western observers have raised concerns about potential Chinese access, narratives that Mauritian scholars dismiss as “Cold War geopolitical anxiety” projecting China’s expansion onto any regional power shift .

3.4 Democratic Accountability and the African Human Rights System

Despite its democratic credentials, Mauritius faces a significant accountability deficit before the African Commission on Human and Peoples’ Rights. The State’s periodic report under the African Charter has been due since 2024. While Mauritius submitted its 11th Periodic Report (covering August 2020 to April 2024), it failed to appear before the Commission at both the 81st Ordinary Session (November 2024) and the 85th Ordinary Session (October 2025) to present the report and engage in constructive dialogue .

This silence raises uncomfortable questions. As the Centre for Human Rights observes, “For a country that frequently presents itself as a model democracy and a defender of the rule of law, Mauritius’ prolonged silence before Africa’s principal human rights body is increasingly difficult to explain” . Mauritius ratified the African Charter in 1992 and has nominated and elected at least two nationals as Commissioners, demonstrating awareness of and engagement with the system. Yet its reporting history reveals patterns of long silences punctuated by consolidated reports covering multiple cycles—a practice that, while technically compliant, undermines the biennial reporting rhythm envisioned by the Charter .

The contrast with Mauritius’s engagement with United Nations mechanisms in Geneva and New York is stark. The State appears regularly before UN treaty bodies and participates actively in the Universal Periodic Review. This selective attention risks reinforcing perceptions that African institutions are treated as secondary to global ones, despite their unique capacity for regionally grounded oversight .

Several communications have been lodged against Mauritius before the Commission, including Devendranath Hurnam v. Mauritius (decided on merits in 2025) and others declared inadmissible . While Commission decisions are recommendatory, they carry authoritative weight as interpretations of the Charter. A delayed or absent state report deprives both the Commission and Mauritian civil society of opportunities for holistic, forward-looking engagement with recurring concerns.

Civil society’s role becomes critical. Observer Status before the Commission allows organizations to submit shadow reports, attend sessions, and ensure lived realities are represented when official narratives may be incomplete. For Mauritian civil society, seeking Observer Status should be viewed as “a strategic necessity, not an administrative luxury” . The year 2026 represents a test of credibility: whether Mauritius will translate its rhetorical commitment to human rights into consistent engagement with the African accountability mechanisms it voluntarily joined.

4. Regional Status: Gateway, Bridge, and Island

4.1 Positioning Within African Regional Architecture

Mauritius occupies a distinctive position in African regional architecture. It is a member of the Southern African Development Community (SADC) and the Common Market for Eastern and Southern Africa (COMESA), as well as the Indian Ocean Commission and the Indian Ocean Rim Association (IORA). This overlapping membership reflects its geographic location as an island state with connections to both continental Africa and the broader Indian Ocean world.

Within SADC, Mauritius participates in regional integration initiatives while maintaining its distinct economic profile as a high-income, services-based economy. The country’s candidacy for IORA Vice-Chair, announced by Foreign Affairs Minister Ramful, signals ambition for enhanced regional leadership . IORA brings together littoral states of the Indian Ocean rim, providing a platform for cooperation on maritime security, fisheries management, and disaster risk reduction—all priorities for Mauritius.

4.2 The Africa Gateway Strategy

A central pillar of Mauritius’s regional positioning is its role as a gateway for investment into Africa. This strategy leverages the country’s strengths: political stability, robust legal institutions, bilingual workforce, double taxation treaties with numerous African states, and sophisticated financial services . International businesses seeking exposure to African markets often establish regional headquarters in Mauritius, benefiting from its business climate while accessing continental opportunities through trade and investment agreements.

The 18th US-Africa Business Summit, scheduled for 2026 in Mauritius, exemplifies this gateway positioning . The summit will bring together approximately 3,000 delegates, including American and African business leaders, government officials, and investors. For Mauritius, hosting represents an opportunity to showcase its value proposition as a stable, well-governed platform for sustainable investment across the continent.

The African Continental Free Trade Area (AfCFTA) amplifies the gateway potential. As intra-African trade expands under the agreement, Mauritius’s services expertise—financial, legal, logistics—positions it to capture value from continental value chains. However, the small domestic market and distance from major African population centers mean Mauritius must compete on quality, reliability, and specialization rather than scale.

4.3 Relations with Key Regional Partners

South Africa is a major economic partner, ranking among Mauritius’s top import sources and export destinations . South African retail, banking, and tourism firms have substantial Mauritian operations. Political relations remain close, with both countries sharing Commonwealth membership and SADC commitments.

Madagascar, as the nearest continental neighbor, shares maritime boundaries and Indian Ocean Commission membership. Trade, while modest relative to South Africa, includes significant re-exports through Port Louis. The two countries coordinate on Indian Ocean affairs, including fisheries management and environmental protection.

France, through its overseas department of Réunion, is both a neighbor and a partner. French is widely spoken, the legal system retains Napoleonic Code influences, and economic links remain substantial. President Macron’s November 2025 visit to Mauritius as the first stop on his Africa tour underscores the enduring importance Paris attaches to the relationship .

5. Geopolitical Status: Navigating Great-Power Competition

5.1 The Indian Ocean Arena

Mauritius sits at the intersection of intensifying great-power competition in the Indian Ocean. The region carries over half the world’s container traffic and one-third of global maritime trade, connecting the energy-producing Gulf states with consuming markets in Asia, Europe, and Africa . Choke points including the Strait of Hormuz, Bab el-Mandeb, and the Malacca Strait render Indian Ocean security a global concern.

For Mauritius, this strategic location confers both opportunities and risks. Opportunities arise from the country’s value as a stable partner for multiple powers, enabling diversified relationships that maximize development benefits. Risks stem from the potential for great-power rivalries to play out in ways that constrain Mauritian policy space or draw the country into conflicts beyond its control.

5.2 India: The “Special and Historic” Partner

India occupies a unique position in Mauritius’s external relations, reflecting deep historical, cultural, and demographic ties. Over two-thirds of Mauritius’s population is of Indian origin, and Indian cultural influences permeate Mauritian society. Hindi is widely spoken, Bollywood films dominate entertainment, and Indian religious practices are integral to daily life .

The bilateral relationship has been elevated to “Enhanced Strategic Partnership,” encompassing defense, maritime security, development cooperation, and economic integration . India’s Vision MAHASAGAR (Mutual and Holistic Advancement for Security and Growth Across Region) places Mauritius at the center of Indian Ocean strategy. Prime Minister Modi’s March 2025 visit for National Day celebrations and Prime Minister Ramgoolam’s September 2025 State Visit to India (his first overseas bilateral visit in his present term) demonstrate mutual commitment .

India’s development assistance is substantial and strategic. The Special Economic Package announced in Varanasi supports infrastructure, employment, and healthcare, including a 500-bed hospital, AYUSH Centre of Excellence, veterinary school, and highway expansion . IIT Madras and the Indian Institute of Plantation Management have signed agreements with the University of Mauritius, deepening educational and research partnerships . For India, Mauritius is not merely a partner but “family”—a relationship PM Modi frames as “spiritual union” rather than mere diplomatic formality .

5.3 China: The Infrastructure and Trade Partner

China has emerged as a major economic partner, with bilateral trade growing substantially and Chinese companies active in infrastructure, real estate, and manufacturing. Mauritius signed a Belt and Road Initiative memorandum of understanding in 2017, and China-financed projects include the extension of Sir Seewoosagur Ramgoolam International Airport, which now handles over 40 percent increased passenger traffic .

Chinese analyses characterize Mauritius as a “development典范” (development model) whose trajectory offers lessons for other developing countries . The resonance between China’s modernization experience and Mauritius’s转型需求 (transformation needs) in AI, digital economy, and climate action creates scope for collaboration beyond traditional infrastructure. Germany-based economist Wagnall notes that Mauritius and China, despite vast scale differences, share “the ambition to leap from emerging nation to high-tech nation” .

However, China’s growing presence has attracted scrutiny from Western powers concerned about strategic competition. Some observers have linked the Chagos sovereignty restoration to potential Chinese military access—narratives that Mauritian scholars dismiss as unfounded. As University of Mauritius law professor Kumar told Global Times, “Such narratives are merely the continuation of Cold War geopolitical anxiety, where any shift in regional power dynamics is mechanically interpreted as ‘Chinese expansion'” .

5.4 United States: The Security and Trade Partner

The United States maintains substantial interests in Mauritius, centered on security cooperation and trade. The Diego Garcia military base, leased from the UK but located on Mauritian territory, remains a critical strategic asset supporting U.S. operations across the Middle East and Indian Ocean . The 99-year lease arrangement under the UK-Mauritius sovereignty agreement ensures continued U.S. access while formally recognizing Mauritian sovereignty .

Trade relations operate under the African Growth and Opportunity Act (AGOA), providing duty-free access for qualifying Mauritian exports. Total goods and services trade reached approximately $8.3 billion in 2024 . The textile and apparel sector benefits significantly from AGOA preferences, though uncertainty persists regarding renewal and potential tariff changes .

The 2026 US-Africa Business Summit, hosted in Mauritius, reflects Washington’s interest in deepening commercial ties beyond security cooperation. The summit provides a platform for U.S. businesses to explore opportunities in Mauritius and, through its gateway, across Africa .

5.5 France: The Former Colonial Power

France’s relationship with Mauritius is complex, shaped by colonial history, cultural affinity, and enduring economic links. French is widely spoken, the legal system retains Napoleonic Code elements, and French companies maintain substantial presence in banking, retail, and tourism. President Macron’s November 2025 visit, as the first stop on his Africa tour, signaled continued French engagement .

However, sovereignty questions linger. France administers several scattered islands (Glorioso, Juan de Nova, Europa, Bassas da India) claimed by Madagascar, creating occasional tensions. More fundamentally, France’s continued role in Indian Ocean affairs through its overseas departments (Réunion, Mayotte) and military presence creates both cooperation opportunities and competitive dynamics with regional actors.

5.6 The Balancing Act: Mauritius’s Strategic Autonomy

Mauritius’s approach to great-power competition is characterized by pragmatic balancing. The country maintains diversified relationships, avoiding exclusive alignment with any single power while extracting maximum development benefit from each. As the Global Times analysis observes, “Mauritius demonstrates pragmatic diplomatic wisdom: not binding itself to any single side, but conducting selective cooperation across multiple fields” .

This strategy rests on several foundations. First, democratic institutions and rule of law provide predictability and credibility that attract partners across ideological divides. Second, economic diversification reduces dependence on any single partner or sector. Third, active participation in multilateral forums—the UN, African Union, SADC, IORA—provides platforms for advancing national interests without bilateral entanglement. Fourth, the Chagos sovereignty campaign demonstrated the effectiveness of legal and diplomatic advocacy in achieving objectives against powerful states.

The challenge for Mauritius is sustaining this balance amid intensifying competition. As Indian and Chinese strategic rivalry deepens, and as U.S.-China tensions permeate the Indian Ocean, pressures for alignment will grow. Mauritius’s continued success will depend on maintaining the diplomatic agility and institutional strength that have served it well to date.

6. Conclusion: The Imperative of Accountability

Mauritius’s economic and political status in early 2026 is defined by remarkable achievements and persistent challenges. Economically, the country has secured its position as Africa’s most prosperous and diversified small-state economy, with GDP per capita exceeding $11,500, comfortable reserves, and sophisticated services sectors . The fiscal consolidation underway, while politically difficult, strengthens long-term sustainability. The blue economy strategy opens new frontiers for growth and sovereignty. Projected 3.5 percent growth in 2026 reflects normalization after post-pandemic surges but remains respectable by regional standards .

Politically, Mauritius has reaffirmed its democratic credentials through the October 2024 peaceful alternation. The Ramgoolam administration has articulated an ambitious international agenda, hosting major conferences and deepening partnerships with India, China, the United States, and others . The Chagos sovereignty agreement, scheduled for 2026 implementation, represents the culmination of decades of diplomatic and legal advocacy .

Geopolitically, Mauritius navigates intensified great-power competition with pragmatic balance, extracting development benefits from multiple partners while maintaining strategic autonomy. Its gateway strategy positions it to capture value from continental integration under the AfCFTA and from growing investor interest in Africa .

Yet this impressive edifice rests on foundations that require continuous reinforcement. Youth unemployment at 20 percent, income inequality with a Gini coefficient of 37, and skills shortages in high-value sectors constrain inclusive growth . Climate vulnerability poses existential risk demanding sustained investment. Most troublingly, Mauritius’s silence before the African Commission on Human and Peoples’ Rights raises fundamental questions about accountability. A state that champions democracy and rule of law must demonstrate those principles consistently, including before the continental institutions it voluntarily joined. As the Centre for Human Rights observes, “Silence before the African Commission does not make scrutiny disappear—it merely postpones it” .

The question for 2026 is whether Mauritius will translate its development success into deepened accountability. Hosting the US-Africa Business Summit and chairing IORA demonstrate global engagement. Reporting to the African Commission and appearing for constructive dialogue would demonstrate continental commitment. The two are not alternatives but complements: a state serious about its African identity and democratic narrative must engage fully with both. Mauritius’s status as a “development典范” depends not only on what it achieves economically but on how it accounts for itself politically—including before the human rights body of the continent it calls home.

References

-

Global Economic Diversification Index. (2026, January 27). Mauritius Country Profile.

-

环球时报. (2026, February 7). 「环时深度」毛里求斯:从“印度洋钥匙”到“发展典范”. 中非合作论坛.

-

Government Information Service, Prime Minister’s Office. (2026, January 16). Foreign policy, a catalyst for economic diplomacy and regional cooperation. Government of Mauritius.

-

Coface. (2026). Maurice : analyse des risques économiques et politiques.

-

The EastAfrican. (2026, February). *The great reckoning is (finally) here: Why 2026 is East Africa’s brutal wake-up call*.

-

MarketScreener. (2026, February 13). *Mauritius Unveils Bold New Chapter for India – Sets Sights On Tier 2/3 Markets and ‘Beyond Beaches’ Growth Following OTM 2026*.

-

Mid-day. (2026, February 10). PM Modi and Mauritian counterpart Ramgoolam discuss progress in bilateral ties ahead of AI Summit.

-

Coface Austria. (2026). Mauritania: Länderrisiko und Länderbewertung. [Note: This result pertains to Mauritania, not Mauritius, and was not used in the paper.]

-

Centre for Human Rights, University of Pretoria. (2026, January 25). African Commission on Human and Peoples‘ Rights: Is Mauritius ready to submit its state report in 2026?

-

L’Express. (2025, June 7). *Budget 2025-2026 : “Well done, Prime Minister”*.