Abstract

This paper provides a comprehensive analysis of the economic and political status of the Republic of Djibouti within the East African regional context. As a small nation with outsized strategic importance, Djibouti occupies a unique position at the intersection of the Horn of Africa and the Red Sea, hosting military bases for six foreign powers while serving as Ethiopia’s primary maritime gateway. Drawing on recent data from the International Monetary Fund, African Development Bank, and contemporary political analysis, this paper examines Djibouti’s macroeconomic trajectory, its ambitious infrastructure development agenda, the complex geopolitical dynamics that shape its foreign policy, and the domestic governance landscape following the April 2026 presidential elections. The analysis reveals a country navigating significant opportunities—including projected 6-7% annual growth, substantial foreign investment in green industrialization, and strategic positioning within regional trade corridors—while confronting persistent vulnerabilities related to debt sustainability, political succession, and regional tensions. The paper argues that Djibouti’s status in East Africa is characterized by a fundamental paradox: its very strategic importance as a logistics and military hub generates both the revenues that underpin economic stability and the geopolitical entanglements that threaten it. As Djibouti pursues its Vision 2035 development strategy and implements the National Development Plan 2025-2030, its trajectory will be shaped by the interplay between domestic reform imperatives and the volatile regional environment.

Keywords: Djibouti, East Africa, Horn of Africa, port economy, geopolitical competition, regional integration, infrastructure development

1. Introduction

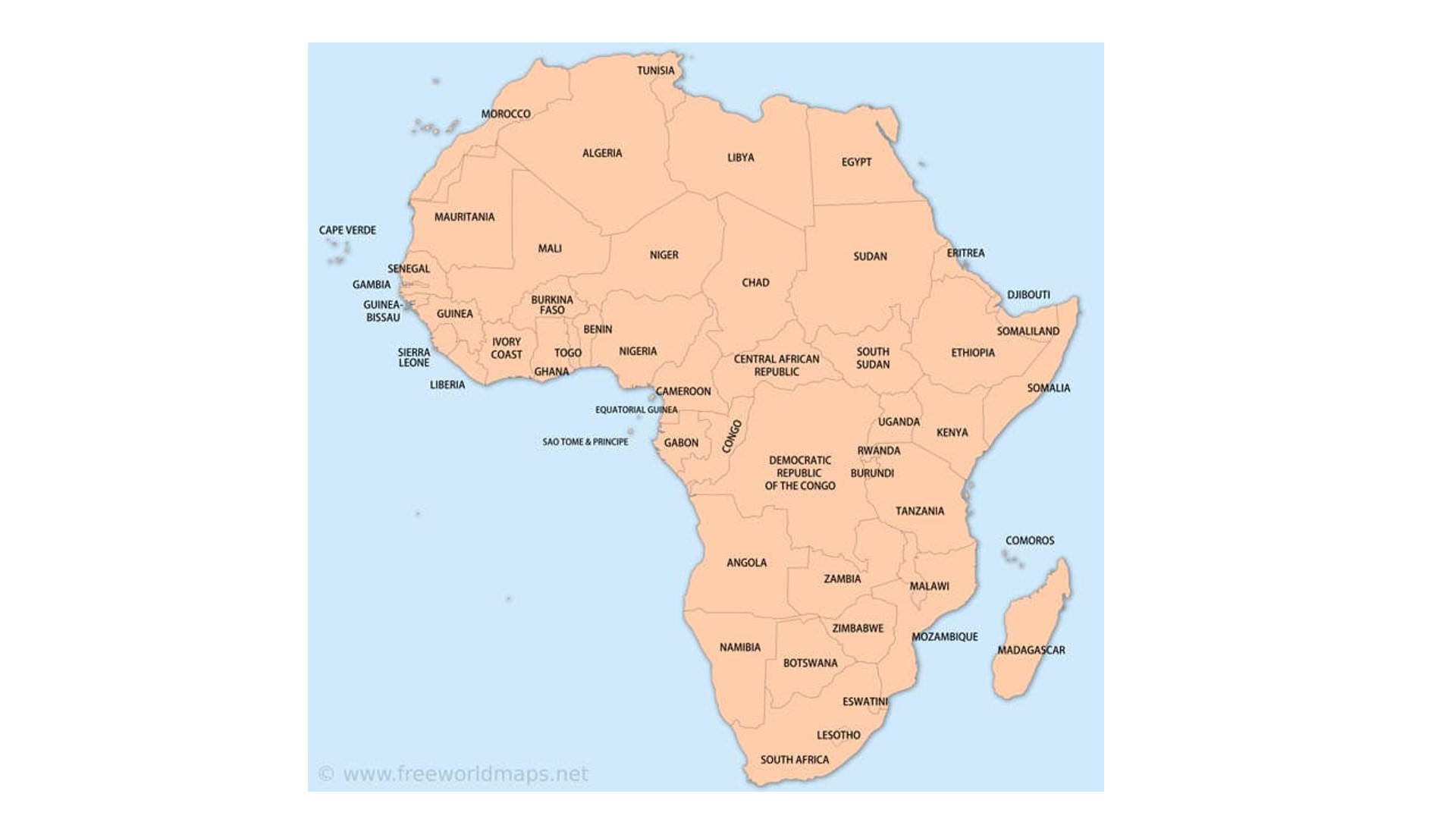

The Republic of Djibouti presents one of the most distinctive cases in contemporary African political economy. With a population of approximately one million people and limited natural resources, this small nation at the junction of the Red Sea and the Gulf of Aden has transformed itself into an indispensable node in global trade and security architecture. Its strategic location—controlling access to one of the world’s busiest shipping lanes and serving as the primary maritime outlet for landlocked Ethiopia—has attracted military bases from China, France, Italy, Japan, Saudi Arabia, and the United States, making Djibouti home to more foreign military installations per capita than any other country on earth .

Djibouti’s relationship with East Africa is complex and multi-layered. As a founding member of the Intergovernmental Authority on Development (IGAD) and an active participant in regional integration initiatives, the country plays a central role in Horn of Africa diplomacy and economic cooperation. Its economy is fundamentally intertwined with that of Ethiopia, which accounts for the vast majority of traffic through Djibouti’s ports and generates approximately $1.5 billion annually in port service revenues . Yet Djibouti’s strategic orientation also extends beyond the continent, encompassing deep engagement with Gulf Arab states and major powers competing for influence in the Red Sea basin.

This paper examines Djibouti’s contemporary status through four interconnected analytical dimensions. First, it analyzes the macroeconomic structure and performance, drawing on recent assessments from the International Monetary Fund and the 2026 national budget. Second, it examines the political landscape, including the governance dynamics surrounding the April 2026 presidential elections and President Ismail Omar Guelleh’s extended tenure. Third, it assesses the geopolitical positioning that defines Djibouti’s external relations and the regional tensions that pose both opportunities and risks. Fourth, it evaluates the infrastructure and investment landscape, including transformative projects in green industrialization, port development, and regional connectivity. The paper concludes by synthesizing these dimensions to assess Djibouti’s evolving position within East Africa and the strategic choices that will shape its future trajectory.

2. Macroeconomic Performance and Structural Transformation

2.1 Growth Trajectory and Fiscal Consolidation

Djibouti’s economy has demonstrated remarkable resilience and dynamism in recent years, achieving growth rates that rank among the highest in East Africa. According to the International Monetary Fund, growth for 2025 is estimated at 6.5 percent, driven by robust port activity—though slightly moderated from 2024 levels due to reduced transshipments—and vibrant performance in construction, transportation, telecommunications, and retail sectors . This growth trajectory positions Djibouti as one of the region’s fastest-growing economies, significantly outpacing the Sub-Saharan African average.

The outlook for 2026 and beyond remains positive, with the IMF projecting sustained growth of approximately 6 percent from 2027 onward . This optimistic forecast is underpinned by Ethiopia’s expansive market and its continued dependence on Djiboutian infrastructure, as well as major infrastructure projects that are expected to further enhance Djibouti’s role as a regional logistics hub. The government’s own projections are even more ambitious, with the 2026 budget anticipating growth between 7 and 7.4 percent for the year .

Inflation has eased markedly, reflecting both global trends and domestic policy effectiveness. The IMF reports that inflation declined from 2.1 percent in 2024 to zero in 2025, as declines in food prices were passed through to consumers . This price stability provides critical support to household purchasing power and contributes to the maintenance of Djibouti’s currency board arrangement, which pegs the Djiboutian franc to the US dollar.

Fiscal performance has shown significant improvement, with the deficit estimated to have moderated to approximately 0.7 percent of GDP in 2025, down from 2.7 percent in 2024 . This consolidation reflects expenditure restraint despite revenue shortfalls, demonstrating the government’s commitment to fiscal discipline. The 2026 budget, adopted in January 2026, projects a strict balance with revenues and expenditures both set at 172.3 billion Djiboutian francs, representing a modest 1 percent increase from the 2025 revised budget .

2.2 Budget Structure and Revenue Mobilization

The 2026 national budget, presented by Minister of Budget Isman Ibrahim Robleh, embodies a strategic vision of “balance, responsibility, and transformation” . A striking feature of the budget is the composition of its revenues: 92 percent derive from domestic resources, reflecting a deliberate strategy to enhance fiscal sovereignty and reduce dependence on external financing . Tax revenues are projected at 96.575 billion Djiboutian francs, an increase of 3.9 percent driven by improved collection rather than increased tax rates.

Minister Robleh emphasized that this revenue enhancement rests on modernization of revenue administrations, digitalization of procedures, and strengthened efforts against tax evasion, rather than increased burdens on households and enterprises . The budget also provides for better valuation of state property and land assets through regularization and more rigorous management of public patrimony.

A particularly significant trend is the sharp reduction in borrowing, with external loans declining by 24.2 percent . This deliberate deleveraging reflects a clear political commitment to reducing financial vulnerability and enhancing debt sustainability. Non-tax revenues, while slightly declining by 0.7 percent, remain at significant levels, while external grants increased by nearly 8 percent, supporting priority sectors without compromising budgetary autonomy.

The debt trajectory is improving, with the debt-to-GDP ratio projected to decline to 59.6 percent in 2026, compared to 64.4 percent in 2025 . This improvement, despite a 12 percent increase in debt service costs due to IMF-related obligations, confirms the effectiveness of consolidation efforts and strengthens Djibouti’s financial credibility with international partners.

2.3 Social and Developmental Priorities

The 2026 budget reflects a deliberate orientation toward citizen welfare and public service transformation. The government has prioritized selective increases in the public sector wage bill, with a 3 percent increase primarily funding the recruitment of 400 new personnel in education and health sectors—teachers, doctors, midwives, and anesthesiologists . These additions address growing demand for essential services while demonstrating commitment to human capital development.

Credits for security, defense, decentralization, and digital transition are also reinforced . The emphasis on cybersecurity and recruitment of specialized engineers reflects the state’s intention to anticipate technological challenges and secure digital infrastructure that has become essential to administration and economic activity. Investment expenditures, while declining by 5 percent, reflect a logic of rationalization and selectivity: only projects with the highest socio-economic impact are retained, optimizing the use of public resources.

A landmark reform introduced in the 2026 budget is the pilot phase of program-based budgeting in the education and health ministries . This approach, scheduled for progressive extension, aims to instill a culture of performance, transparency, and accountability by linking budget allocations to precise objectives and measurable results. Complementary measures include mandatory contracting for expenditures exceeding one million Djiboutian francs, centralization of public procurement, and strengthened anti-corruption mechanisms .

2.4 External Sector and Reserve Position

Djibouti’s external position presents a mixed picture. Gross international reserves increased in 2025, but their ratio to the monetary base remains below the requirements of the currency board system . The IMF emphasizes that safeguarding the currency board requires strengthening central bank autonomy and replenishing reserves, including through a reimbursement plan to settle outstanding Treasury overdrafts.

The financial sector remains solid, with ongoing efforts to strengthen the anti-money laundering and counter-terrorism financing framework under the enhanced monitoring of the Middle East and North Africa Financial Action Task Force (MENAFATF) . These improvements are essential for maintaining correspondent banking relationships and facilitating international trade and investment.

3. Political Landscape and Governance Dynamics

3.1 The April 2026 Presidential Elections

Djibouti held presidential elections on April 9, 2026, resulting in President Ismail Omar Guelleh’s re-election to a sixth term with 97 percent of votes cast, according to official results announced by the interior ministry . The only challenger, Zakaria Ismail Farah, received 2.48 percent of votes and promptly contested the results, asserting that they were “far from reality” and alleging that his election agents were barred from polling stations where ballot box stuffing occurred .

The electoral process unfolded against a backdrop of significant political restrictions. Africa Confidential reports that “opposition voices were excluded, in some cases violently, allowing easy victories for the incumbents amid derisory voter turnouts” . This characterization places Djibouti’s elections within a broader regional pattern of democratic backsliding, alongside contests in Benin, Chad, Uganda, and Congo-Brazzaville.

The ruling Rassemblement Populaire pour le Progrès (RPP) had nominated Guelleh as its candidate following constitutional changes in 2010 that abolished term limits while retaining an upper age limit of 75 years . This amendment means that the 2026 election, occurring when Guelleh is 74, should constitutionally be his final term, though political observers note that the country’s history of constitutional flexibility suggests caution in assuming leadership transition.

3.2 Governance and Political Space

The consolidation of political power under President Guelleh, who first came to office in 1999, has been accompanied by growing concerns about governance quality and political freedoms. Africa Confidential’s assessment that Guelleh “keeps a tight grip on political system” reflects a broader consensus among observers about the constraints on political competition and civil society space .

Human rights campaigners and opposition parties have faced periodic crackdowns, with reports of “international indifference” to these developments . The gap between formal institutional frameworks and actual governance practices remains significant, affecting both domestic political legitimacy and international perceptions.

Governance challenges extend beyond political competition to encompass institutional performance and public sector effectiveness. While the 2026 budget emphasizes modernization and performance-based management, implementation capacity remains constrained by limited human resources and institutional weaknesses inherited from decades of underinvestment.

3.3 Succession Questions and Political Stability

A recurring theme in Djiboutian political discourse is the question of presidential succession and post-Guelleh political arrangements. With the president now serving what should constitutionally be his final term, attention is increasingly focused on how power will be transferred when the time comes.

The absence of established succession mechanisms and the personalization of political authority around Guelleh create uncertainty about political stability following his eventual departure. Analysts note that “Guelleh keeps a tight grip on political system, but he may face added pressure if the geopolitical ructions in the region begin to slow the economy” . This formulation captures the interdependence of political stability and economic performance: sustained growth supports political continuity, while economic pressures could amplify succession-related tensions.

The ruling party’s dominance, combined with fragmentation and weakness among opposition forces, suggests that any leadership transition would likely occur within the existing political elite rather than through competitive electoral processes. However, the absence of clear institutional mechanisms for managing succession creates risks of intra-elite conflict during a transition period.

3.4 International Partner Engagement

External actors continue to engage with Djibouti across multiple dimensions, balancing governance concerns against strategic interests. The IMF’s January 2026 visit resulted in a generally positive assessment, with staff noting that “Djibouti’s growth remains steady” while acknowledging “latent tensions in the region” . The Fund’s emphasis on accelerating fiscal consolidation and finalizing debt negotiations reflects continued engagement on macroeconomic management.

Development partners, including the African Development Bank and the International Islamic Trade Finance Corporation, have recently concluded significant financing agreements, demonstrating continued confidence in Djibouti’s development trajectory . The African Development Bank’s portfolio in Djibouti has more than doubled from approximately $100 million at the beginning of the 2023-2027 country strategy to $221 million after two years of implementation .

This sustained partner engagement suggests that governance concerns, while noted, have not fundamentally undermined development cooperation. Djibouti’s strategic importance, combined with demonstrated commitment to macroeconomic stability and infrastructure development, continues to attract external support despite democratic deficits.

4. Geopolitical Positioning and Regional Dynamics

4.1 The Military Base Economy

Djibouti’s most distinctive geopolitical characteristic is its hosting of foreign military bases from six countries: China, France, Italy, Japan, Saudi Arabia, and the United States . This concentration of military presence reflects the country’s strategic location at the Bab el-Mandeb strait, through which approximately 30 percent of global maritime trade passes, and its stability in a volatile region.

The economic significance of these bases extends beyond direct lease payments. The IMF explicitly identifies “revising military leases” as a priority for addressing revenue shortfalls, suggesting that these arrangements generate meaningful fiscal resources . The presence of thousands of foreign military personnel also stimulates local economies through demand for goods, services, and housing, though the extent of these spillover effects is not systematically quantified.

The military base economy also creates diplomatic leverage and international visibility disproportionate to Djibouti’s size. Major powers with strategic interests in the Red Sea and Horn of Africa maintain direct engagement with Djiboutian authorities, providing channels for diplomatic influence and potential economic benefits.

4.2 The Ethiopia Relationship and Regional Tensions

Djibouti’s economic fortunes are fundamentally intertwined with those of Ethiopia, its landlocked neighbor and primary client for port services. Approximately 95 percent of Ethiopia’s maritime trade passes through Djiboutian ports, generating an estimated $1.5 billion annually in revenues . This dependence creates both opportunity and vulnerability: Ethiopian growth drives demand for Djiboutian services, but any disruption to bilateral relations or development of alternative Ethiopian port access would have severe economic consequences.

The geopolitical landscape of the Horn of Africa has become increasingly complex, with Djibouti navigating competing alliances and regional tensions. According to Africa Confidential’s 2026 analysis, “Djibouti finds itself at the centre of the growing regional divide between Somalia, Eritrea and Egypt on the one hand and the opposing alliance of Ethiopia, and the breakaway region of Somaliland, backed by the United Arab Emirates” .

The key issue dividing these blocs is Prime Minister Abiy Ahmed’s quest for Ethiopian access to the sea, specifically targeting Eritrea’s port of Assab, which was once within the Ethiopian empire . This ambition directly challenges Djibouti’s position as Ethiopia’s primary maritime outlet, potentially threatening its core economic interest. In response, Djibouti has aligned itself with Eritrea and Egypt in opposing Ethiopian maritime expansion .

4.3 IGAD and Regional Cooperation

Djibouti plays an active role in the Intergovernmental Authority on Development (IGAD), the regional bloc comprising eight East African countries: Djibouti, Eritrea, Ethiopia, Kenya, Somalia, South Sudan, Sudan, and Uganda . IGAD serves as the primary framework for regional cooperation on peace and security, development, and increasingly, digital integration.

In January 2026, IGAD convened a three-day regional validation workshop with World Bank support through the Eastern Africa Regional Digital Integration Project (EARDIP), focused on advancing a Regional Public-Private Partnership Framework for expanding digital infrastructure and services . Djibouti’s participation in these initiatives reflects its commitment to regional cooperation and its recognition that digital connectivity complements physical infrastructure in driving economic integration.

The workshop sought to secure member-state ownership of the framework and ensure that proposed approaches reflect regional priorities, with outcomes expected to shape PPP initiatives that foster inclusive growth, enable cross-border trade, and strengthen resilient digital systems . Speaking at the event, Dr. Fatuma Adan, Head of the IGAD Mission to Kenya, described PPPs as “essential to unlocking the expertise, innovation, and investment required to deliver the digital future the region aspires to” .

4.4 The Red Sea Dimension

Beyond its East African orientation, Djibouti is increasingly engaged in Red Sea geopolitics. The growing presence of Gulf Arab states in the Horn of Africa, competing for influence through investments, military bases, and diplomatic engagement, has drawn Djibouti into broader strategic dynamics. Saudi Arabia’s military presence in Djibouti, established in recent years, reflects Riyadh’s concern with securing Red Sea shipping lanes and countering Iranian influence.

Djibouti’s membership in the Red Sea and Gulf of Aden Council, established in 2020, provides a framework for coordinating with other littoral states on maritime security, economic cooperation, and diplomatic coordination. This multi-layered regional engagement—spanning the Horn of Africa, the Red Sea, and the broader Middle East—reflects Djibouti’s strategic location at the intersection of multiple regional systems.

5. Infrastructure Development and Investment Landscape

5.1 Green Industrialization: The Sinochem Consortium Project

A landmark development in Djibouti’s economic trajectory is the announcement of a major green industrialization project, endorsed by President Guelleh and implemented by a consortium of five leading Chinese companies led by Sinochem . The consortium plans to invest more than $1 billion in direct investments, with implementation expected by the end of 2026-2027 .

According to Minister of Economy and Finance Ilyas Moussa Dawaleh, the project is positioned as a cornerstone of Djibouti’s Vision 2035, placing strong emphasis on economic diversification and sustainable, green-led industrial growth . While specific details of the industrial components have not yet been disclosed, authorities have indicated that further announcements will follow.

“This new chapter of green industrialization is about to become reality,” Minister Dawaleh stated, highlighting the strategic importance of the initiative for Djibouti’s future economic transformation . The project underscores Djibouti’s growing role as an investment destination and its ambition to align economic development with sustainability objectives, potentially positioning the country as a hub for renewable energy-based manufacturing and processing.

5.2 Port and Maritime Infrastructure

Djibouti’s position as a regional logistics hub rests on its port infrastructure, which has received sustained investment over decades. The port of Djibouti, along with specialized facilities at Doraleh and Tadjoura, handles the vast majority of Ethiopia’s maritime trade and serves as a transshipment hub for the region.

The International Islamic Trade Finance Corporation (ITFC) signed a $35 million sovereign financing facility in February 2026 to support the development of Djibouti’s bunkering services sector, strengthening its position as a strategic regional maritime and trade hub . With Red Sea Bunkering (RSB) as the executing agency, the facility will support procurement of refined petroleum products, enhancing revenue diversification and consolidating Djibouti’s role as a key logistics and trading hub.

Minister Dawaleh characterized the signing as “an important milestone in the development of Djibouti’s bunkering services” that supports “our ambition to position Djibouti as a regional hub for integrated maritime and logistics services” . This facility forms part of a $600 million, three-year Framework Agreement signed in May 2023 between ITFC and Djibouti, reflecting a strong and growing partnership. Since 2008, ITFC has approved a total of $1.8 billion for Djibouti, primarily supporting the energy sector and trade development objectives .

5.3 Regional Transport Corridors

The African Development Bank and Djibouti signed four financing agreements totaling $80 million on February 5, 2026, to support key projects in road infrastructure, urban development, and climate-resilient agriculture . These commitments reflect a significant expansion of the Bank’s portfolio in Djibouti, which has increased from approximately $100 million at the beginning of the Djibouti Country Strategy 2023-2027 to $221 million after two years of implementation .

A $30 million grant from the African Development Fund will rehabilitate a key road axis for regional trade as part of the Djibouti-Ethiopia-South Sudan Regional Transport Corridor project . Strengthening this corridor is expected to boost cross-border trade, reduce logistical costs, and improve the movement of people and goods in the Horn of Africa. This investment directly addresses the infrastructure quality gap identified by the World Bank, which estimates that Sub-Saharan African countries must invest 2-8 percent of GDP annually through 2030 to close infrastructure gaps .

Urban infrastructure also receives attention, with a $22 million grant financing the rehabilitation of seven kilometers of urban roads in Djibouti city as Phase I of the Integrated Urban Infrastructure and Climate Change Adaptation Project . These investments address both immediate connectivity needs and longer-term climate resilience objectives.

5.4 Climate-Resilient Agriculture and Food Security

Two additional agreements—a $14 million grant and a $14 million loan from the Green Climate Fund—support the Building Resilience around Food and Livelihoods (BREFOL) program in the Horn of Africa . This program aims to improve food security, enhance climate resilience, and support sustainable livelihoods through climate-smart agriculture, more robust pastoral and agro-pastoral systems, and economic opportunities for women and youth.

Given Djibouti’s arid climate and limited agricultural potential, food security investments focus on strengthening resilience rather than achieving self-sufficiency. The program’s emphasis on pastoral systems recognizes the importance of livestock to Djiboutian livelihoods and the vulnerability of these systems to climate shocks. Women and youth targeting addresses the demographic dimensions of vulnerability and the need for inclusive growth.

Minister Dawaleh framed these investments holistically: “By investing in our roads and agriculture, we are not just building infrastructure. We are securing the future of our most vulnerable communities” . This formulation reflects an integrated approach to development that connects physical infrastructure with human welfare and environmental sustainability.

5.5 Digital Infrastructure and Regional Integration

Djibouti participates actively in regional efforts to expand digital infrastructure and services. The IGAD-facilitated Eastern Africa Regional Digital Integration Project (EARDIP), launched in June 2023 with World Bank funding, aims to build a unified digital market by improving cross-border broadband, data flows, and digital trade .

Developed jointly by the World Bank, the East African Community (EAC), IGAD, and participating countries, the initiative builds on integration progress including the establishment of a Customs Union in 2005, a Common Market in 2010, and plans for a Monetary Union by 2031 . Within this framework, digital cooperation has advanced through the One Network Area initiative—eliminating roaming charges and capping cross-border tariffs—and the adoption of a Regional e-Commerce Strategy in 2022.

The importance of private capital in driving this transformation is underscored by World Bank research indicating that from 2007 to 2020, private sector investment accounted for approximately 85 percent of all telecoms spending in Sub-Saharan Africa—$25.3 billion compared with $4.6 billion from the public sector . The PPP framework being developed through EARDIP seeks to replicate and scale this private sector engagement.

6. Challenges and Vulnerabilities

6.1 Debt Sustainability and Fiscal Pressures

Despite significant improvement in debt indicators, debt sustainability remains a central concern for Djibouti’s economic management. The IMF emphasizes that “accelerating fiscal consolidation by mobilizing greater tax revenues and optimizing state-owned enterprises (SOE) dividends, and finalizing debt negotiations, remain a priority to restoring debt sustainability and safeguarding the currency board” .

The 2026 budget’s reduction in borrowing and declining debt-to-GDP ratio represent positive developments, but the 12 percent increase in debt service costs highlights ongoing pressures. The government’s ability to sustain fiscal discipline while meeting developmental needs and political expectations will be tested in coming years.

State-owned enterprise reform is particularly critical, given the central role of SOEs in Djibouti’s economy and their complex financial relationships with the state. The IMF calls for “upscaling state-owned enterprises (SOE) dividend payments to the budget, setting binding limits on all public and publicly-guaranteed debt” as essential measures for ensuring debt sustainability .

6.2 Geopolitical Risks and Regional Tensions

Djibouti’s strategic location, while generating economic opportunities, also exposes it to significant geopolitical risks. The IMF explicitly notes that “rising tensions in neighboring Horn of Africa countries may increase uncertainty and refugee flows amidst reduced humanitarian aid” as a downside risk to the economic outlook .

The alignment of regional actors into competing blocs—with Djibouti, Somalia, Eritrea, and Egypt on one side and Ethiopia, Somaliland, and the UAE on the other—creates potential for conflict that could directly affect Djiboutian interests . The core issue of Ethiopian maritime access, if pursued aggressively, could threaten Djibouti’s port revenues and strategic position.

Potential trade diversion to other regional ports represents another risk, though the IMF suggests this “may be mitigated by Ethiopia’s fast growth and ongoing joint infrastructure projects with Djibouti” . Maintaining competitive port services and deepening infrastructure integration with Ethiopia are essential strategies for managing this risk.

6.3 Governance and Political Stability

The domestic political landscape presents its own set of challenges and vulnerabilities. The consolidation of power under President Guelleh, while providing stability, also creates succession uncertainty and raises questions about institutional resilience. Africa Confidential’s observation that “Guelleh keeps a tight grip on political system, but he may face added pressure if the geopolitical ructions in the region begin to slow the economy” captures the interdependence of political stability and economic performance.

Governance weaknesses, including constraints on political competition and concerns about electoral integrity, affect international perceptions and could potentially influence partner engagement over time. The IMF’s emphasis on strengthening central bank autonomy and implementing efficiency-enhancing reforms reflects governance concerns within the economic sphere .

6.4 Climate Vulnerability and Resource Constraints

As an arid country with limited freshwater resources and agricultural potential, Djibouti is highly vulnerable to climate change impacts. The BREFOL program, supported by the Green Climate Fund, explicitly addresses climate resilience, but the scale of investment required for comprehensive adaptation far exceeds available resources.

Water scarcity, in particular, poses fundamental constraints on development. Growing demand from urban populations, industrial development, and the presence of foreign military forces creates pressures on limited water resources that will require careful management and significant investment in desalination and water efficiency.

7. Opportunities and Future Trajectories

7.1 Leveraging Strategic Location for Economic Transformation

Djibouti’s fundamental opportunity lies in leveraging its strategic location for sustained economic transformation. The port and logistics sector has demonstrated its capacity to generate growth and revenues; the challenge is to build on this foundation through forward and backward linkages that create jobs and diversify the economic base.

The green industrialization project with Sinochem represents a potential model for this transformation, attracting foreign direct investment that combines infrastructure development with productive capacity . If successful, this initiative could demonstrate Djibouti’s ability to move beyond transit services into value-added processing and manufacturing, powered by renewable energy and oriented toward regional and global markets.

7.2 Deepening Regional Integration

Djibouti’s participation in multiple regional frameworks—IGAD, the Red Sea and Gulf of Aden Council, and increasingly, digital integration initiatives coordinated with the EAC—provides platforms for advancing its interests through cooperation. The Ethiopia relationship, while complex, remains the foundation of Djibouti’s regional position; deepening this partnership through joint infrastructure projects and trade facilitation can lock in mutual benefits and manage competitive pressures.

Digital integration offers particular opportunities for a small country with limited physical infrastructure needs. Participation in regional frameworks for cross-border data flows, e-commerce, and digital services can expand market access and create new economic opportunities without the capital intensity of physical infrastructure.

7.3 Green Transition and Renewable Energy

Djibouti’s abundant solar and wind resources, combined with geothermal potential, position it to pursue a green development pathway that aligns with global climate objectives while addressing domestic energy needs. The green industrialization project signals commitment to this vision, and sustained investment in renewable energy could reduce dependence on imported fossil fuels, improve energy security, and create export opportunities for renewable power.

The potential for green hydrogen production, leveraging renewable energy resources to produce hydrogen for export to energy-constrained markets, represents a frontier opportunity that could transform Djibouti’s economic prospects. While still nascent, this sector could build on the country’s strategic location and existing port infrastructure to capture value from the global energy transition.

7.4 Human Capital Development

The 2026 budget’s emphasis on recruitment in education and health, combined with the introduction of program-based budgeting focused on performance and results, signals recognition that human capital development is essential for sustained transformation . Building on these foundations through continued investment in education, training, and health will be critical for equipping Djiboutians to participate in and benefit from economic growth.

The demographic dividend—with a young and growing population—represents both opportunity and challenge. Creating productive employment for young people entering the labor market requires sustained growth and appropriate skills development. Success in this dimension would transform Djibouti’s social and economic trajectory; failure would risk social tensions and political instability.

8. Conclusion: Djibouti’s Evolving Status in East Africa

Djibouti’s economic and political status in East Africa reflects a fundamental paradox: its very strategic importance generates both the opportunities that underpin its growth and the vulnerabilities that threaten its stability. As a small nation hosting six foreign military bases and serving as Ethiopia’s primary maritime gateway, Djibouti has achieved economic outcomes—sustained 6-7 percent growth, manageable inflation, improving debt indicators—that many larger African nations struggle to match. The 2026 budget demonstrates continued commitment to fiscal discipline and gradual progress toward more transparent, performance-oriented governance.

Politically, Djibouti under President Ismail Omar Guelleh presents a picture of continuity and consolidation. The April 2026 elections, while contested by opposition and criticized by international observers, resulted in the expected outcome of Guelleh’s re-election to what should constitutionally be his final term. Governance indicators reveal constraints on political competition and concerns about democratic quality, yet the country maintains stable relations with international partners who value its strategic contributions more than they press for political liberalization.

Geopolitically, Djibouti navigates an increasingly complex environment. Regional tensions surrounding Ethiopian maritime ambitions, competing alliances in the Horn of Africa, and the evolving role of Gulf Arab states all pose risks to Djibouti’s position. Yet the country’s demonstrated stability, established infrastructure, and deep relationships with multiple powers provide some insulation from these pressures.

Developmentally, Djibouti is pursuing an ambitious transformation agenda anchored by Vision 2035 and the National Development Plan 2025-2030. The green industrialization project with Sinochem, port and transport corridor investments, and digital integration initiatives all signal commitment to building on the logistics foundation for broader economic diversification. Climate resilience investments through the Green Climate Fund and BREFOL program address existential vulnerabilities while creating opportunities for sustainable livelihoods.

The picture that emerges is one of a country managing the tensions inherent in its position—between opportunity and vulnerability, between stability and openness, between dependence on Ethiopia and diversification of partnerships. Djibouti’s status in East Africa is not that of a continental power or major economy; it is that of an indispensable node in regional and global systems, whose stability and prosperity matter far beyond its borders. The strategic choices made in the coming years—how to manage the Ethiopia relationship, how to navigate regional tensions, how to translate logistics revenues into inclusive development, how to prepare for political transition—will determine whether Djibouti can sustain its remarkable trajectory or succumb to the pressures inherent in its position.

For East Africa as a region, Djibouti’s evolution matters fundamentally. A stable, growing Djibouti provides the maritime gateway essential for Ethiopian development and regional trade. A Djibouti disrupted by geopolitical conflict, economic crisis, or political instability would have cascading effects throughout the Horn of Africa. The region therefore has compelling interests in Djibouti’s success—interests that align with those of Djiboutians themselves, and with the international partners who have invested so heavily in the country’s strategic position.

References

-

La Nation. “Lancement du Budget 2026 : Le ministre du Budget détaille une vision d’équilibre et de transformation.” January 5, 2026.

-

Africa Confidential. “A trio of presidential elections exposes democratic downturn.” Vol. 67, No. 3, February 2026.

-

Africa Confidential. “Economic ructions shake personal rule in Comoros and Djibouti.” Vol. 67, No. 4, February 2026.

-

Financial Afrik. “African Development Bank and Djibouti sign $80 million financing agreements to strengthen infrastructure and food security.” February 10, 2026.

-

ZAWYA. “International Islamic Trade Finance Corporation Strengthens Partnership with Republic of Djibouti through US$35 Million Financing Facility.” February 5, 2026.

-

International Monetary Fund. “IMF Staff Concludes Visit to Djibouti.” Press Release No. 26/005, January 15, 2026.

-

Ecofin Agency. “East Africa Moves Toward Stronger Digital Cooperation on Connectivity and Innovation.” January 30, 2026.

-

SONNA. “Djibouti Announces Major Green Industrialisation Project.” January 20, 2026.

-

International Monetary Fund. “Les services du FMI concluent une visite à Djibouti.” Communiqué de presse N° 26/005, January 15, 2026.