Abstract: Africa stands at a critical juncture, caught between an escalating debt crisis and an international financial architecture (IFA) ill-equipped to resolve it. This article examines the structural origins of Africa’s current debt distress, argues that existing multilateral frameworks are failing, and analyzes the continent’s push for systemic reform. It concludes that without profound changes to the global financial system, sustainable development and stability in Africa will remain elusive.

1. The Anatomy of a Crisis: Beyond Pandemic Narratives

While the COVID-19 pandemic and subsequent global shocks acted as catalysts, Africa’s debt distress is fundamentally structural. The composition of debt has shifted dramatically since the Heavily Indebted Poor Countries (HIPC) Initiative era.

- The Creditor Shift:Unlike the past, where debt was primarily owed to multilateral institutions and Paris Club governments, today’s landscape is fragmented. A significant portion (approximately 40% for many low-income countries) is owed to private bondholders (via Eurobonds) and non-Paris Club bilateral lenders, primarily China. This “multi-creditor” reality complicates coordination immensely.

- The Cost of Capital:Despite being riskier, African sovereigns pay a premium. Yields on Eurobonds are often 5-8 percentage points higher than developed market bonds, diverting scarce resources to debt service. In 2023, African governments spent more on debt servicing than on healthcare in many cases.

- The Climate Finance-Debt Nexus:Many debt-distressed nations are also acutely vulnerable to climate change. They are forced to borrow at high costs to fund climate adaptation, creating a perverse cycle where they pay to address crises they did not create.

2. The Failure of the Existing Architecture: Gaps and Gridlocks

The current IFA, built post-WWII, is proving inadequate.

- The G20 Common Framework’s Ineffectiveness:Launched in 2020 to provide coordinated debt restructuring for low-income countries, the Framework has been widely criticized. Its processes are opaque, slow, and politically fraught. Only a handful of countries (Chad, Zambia, Ghana, Ethiopia) have applied, with negotiations dragging for years, deterring others from seeking relief for fear of market stigma and protracted uncertainty. The lack of comparability of treatment enforcement between private, Chinese, and traditional bilateral creditors is a fatal flaw.

- IMF’s Limitations:While the IMF provides emergency lending and debt sustainability analyses (DSAs), its toolkit is constrained. Its preferred creditor status means it gets paid first, often leaving less for other creditors and failing to provide a “fresh start.” Its macroeconomic prescriptions can be politically destabilizing and socially painful.

- The “Too Little, Too Late” Problem:Relief arrives only after a country is in full-blown crisis, causing severe human and economic damage. There is no effective mechanism for pre-emptive restructuring or for addressing liquidity crises before they become solvency crises.

3. Africa’s Agenda for Reform: From Taker to Shaper of Rules

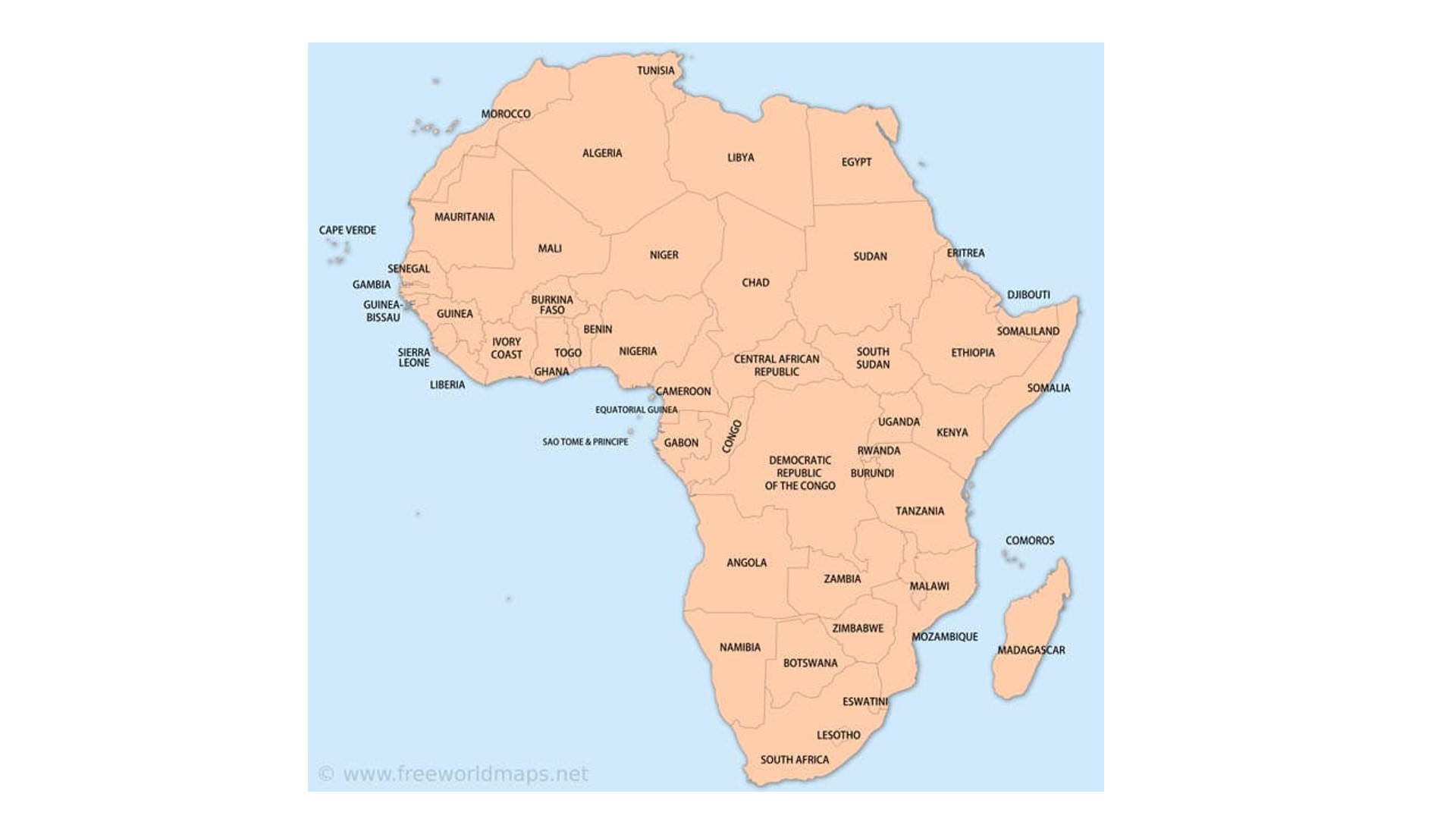

African institutions and scholars are no longer passive recipients. A coherent reform agenda, articulated by the African Union, Afreximbank, and the UN Economic Commission for Africa, is emerging:

- Automatic Debt Standstills & Contingent Financing:Proposals for “state-contingent debt instruments” (where payments are linked to GDP growth or commodity prices) and automatic payment suspensions triggered by climate disasters or health pandemics.

- Reforming Multilateral Development Banks (MDBs):Africa advocates for a massive capital increase for the World Bank and African Development Bank, allowing them to lend more, at cheaper rates, and for longer terms. This includes leveraging callable capital and shifting from shareholder-driven to needs-driven lending.

- Transparency & Legal Overhaul:A global registry of debt obligations is crucial. There are also calls to reform sovereign bond contracts to include Collective Action Clauses (CACs) that make restructuring bind all bondholders, preventing “vulture fund” holdouts.

- SDRs as a Structural Tool:The re-channeling of Special Drawing Rights (SDRs) from rich to vulnerable nations, primarily through the AfDB and other MDBs, is seen as vital. However, the current $100 billion pledge is a fraction of the need. Africa seeks a permanent and automatic SDR reallocation mechanism.

- Local Currency & Capital Market Development:To escape the tyranny of dollar-denominated debt volatility, there is a push to develop deep local capital markets and facilitate more domestic currency borrowing, reducing exchange rate risk.

4. Geopolitics and the New Scramble: A Window for Agency?

The current moment of great power competition (US-China rivalry, EU’s Global Gateway) presents both risks and opportunities for Africa.

- Risk:Creditor fragmentation worsens as geopolitical blocs use finance as a tool of influence, making neutral, rules-based restructuring harder.

- Opportunity:Africa can leverage this competition to negotiate better terms, insisting on reforms. The African Union’s G20 membership is a pivotal platform to institutionalize this agency. The continent can also strengthen South-South financial institutions like the BRICS New Development Bank.

5. Case Study: Zambia – The Canary in the Coal Mine

Zambia’s 2020 default and its agonizingly slow restructuring process under the Common Framework exemplify all the systemic failures. It took over three years to reach a deal with bilateral creditors, with private bondholder talks lagging. The case highlighted: the lack of a clear timeline, China’s hesitance as a new major creditor, and the punishing cost of delay for Zambia’s citizens. Its eventual “kick-the-can” deal, providing minimal relief, underscores the system’s inability to deliver deep, lasting sustainability.

Conclusion: Beyond Bailouts to Systemic Justice

Africa’s debt distress is a symptom of a deeper malady: a global financial system that systematically extracts more resources from the continent than it provides in sustainable finance. Tinkering at the edges is insufficient.

True reform requires a paradigm shift—from a system designed for crisis management to one built for prevention and justice. This means acknowledging the role of exogenous shocks (climate, pandemics, monetary policy of rich nations) and sharing the burden of adjustment. It requires treating sovereign debt not merely as a financial contract but as a development and human rights issue.

The success or failure of this reform effort will determine not only Africa’s economic trajectory but also the credibility and stability of the global order itself. As African policymakers assert with growing unity, the choice is between an equitable restructuring of the financial architecture or a continued descent into instability that will inevitably have global repercussions.

Sources:

- UNECA (2023). Bridging the Gap: Scaling Up Development Finance in C.

- World Bank (2024). International Debt Report.

- Afreximbank (2023). African Trade Report.

- Bolton, P., et al. (2022). “How to Restructure Sovereign Debt.”

- The Liquidity and Sustainability Facility

- The V20 Groupof climate-vulnerable finance ministers.