Executive Summary: A Continent at an Inflection Point

Africa’s startup landscape is undergoing a radical transformation, evolving from a peripheral niche to a globally recognized hub of innovation. This metamorphosis is being fueled by a potent combination of demographic dynamism, rapid digital adoption, and crucially, the growing sophistication and inflow of venture capital. The narrative has shifted from one of challenges to one of boundless opportunity, where local founders are solving continental and global problems. This article provides a comprehensive analysis of the structure, drivers, key players, and challenges within the African tech ecosystem, with a particular focus on the evolving and indispensable role of venture capitalists as catalysts for growth.

Part I: The African Startup Landscape – A Tapestry of Innovation

Demographic and Digital Foundations

Africa’s foundational strength lies in its demographics: a population of 1.4 billion, 60% under 25, and rapidly urbanizing. Coupled with skyrocketing mobile penetration (over 50% smartphone adoption in key markets), this has created a vast, connected, and young market eager for digital solutions. This “digital leapfrog” phenomenon—bypassing legacy systems like brick-and-mortar banking—has created a greenfield for innovation.

Geographic Hubs and Sectoral Dominance

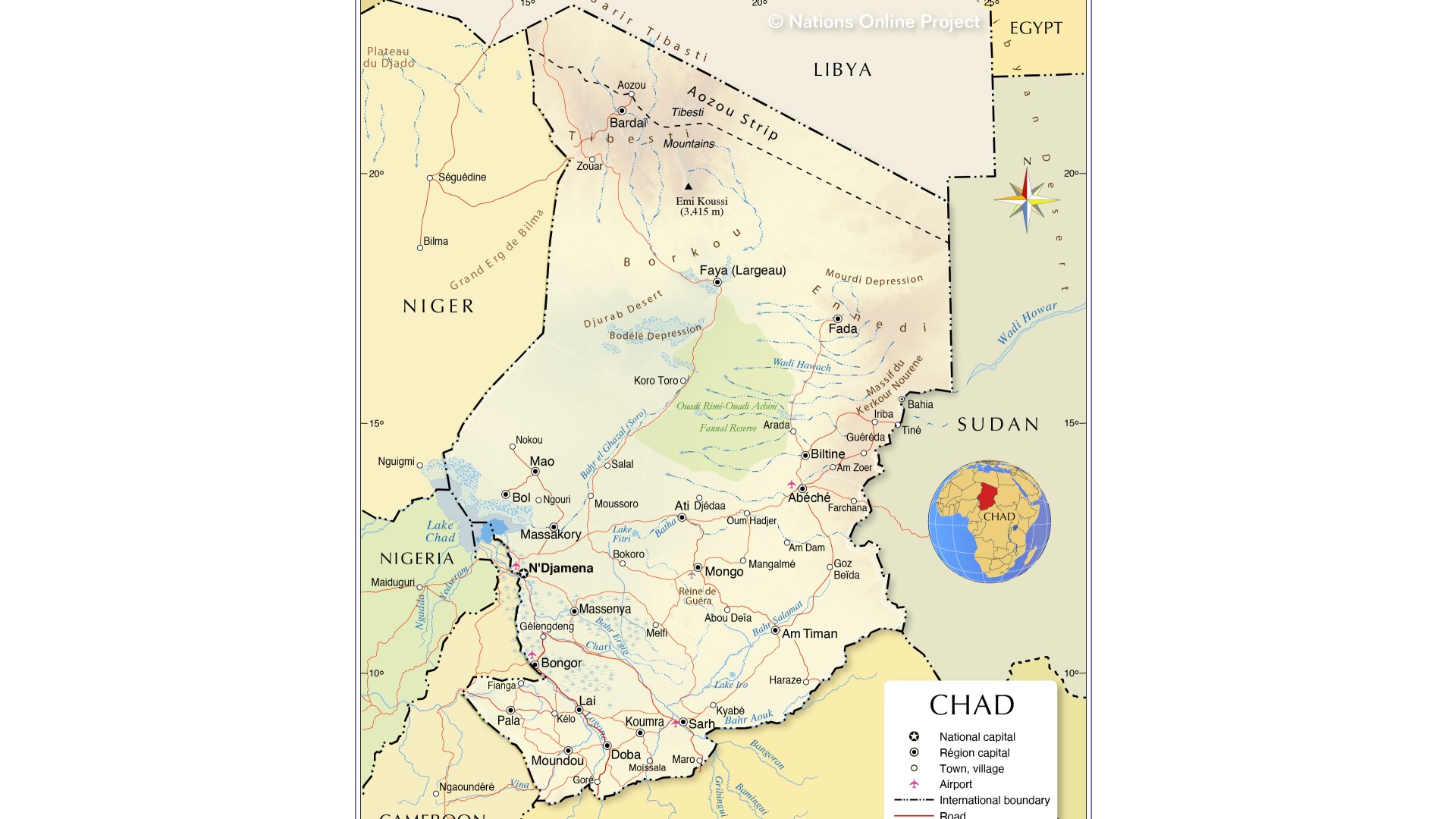

The ecosystem is concentrated around several key hubs, each with distinct strengths:

-

Nigeria: The undisputed leader by volume of deals and funding. Lagos, its commercial capital, is home to fintech giants like Flutterwave and Paystack. Nigeria excels in fintech, logistics, and edtech.

-

Kenya: Nairobi, the “Silicon Savannah,” is a pioneer in mobile money (M-Pesa) and a hub for fintech, agri-tech, and cleantech. It boasts a strong talent pool and supportive regulatory experiments.

-

Egypt: The dominant North African hub, with strengths in fintech, e-commerce, and transport-tech, serving Arabic-speaking Africa and the Middle East.

-

South Africa: Home to the most mature venture ecosystem, with strengths in enterprise software, fintech, and healthtech. Cape Town and Johannesburg are major centers.

-

Emerging Hubs: Ghana (Accra), Rwanda (Kigali), and Senegal (Dakar) are rising stars, offering proactive governments, improving infrastructure, and growing talent pools.

Dominant Sectors:

-

Fintech: Attracts the lion’s share of funding (often over 60%). Solutions span payments, lending, insurance (insurtech), and wealth management, addressing the continent’s massive financial inclusion gap.

-

Cleantech & Agri-tech: Critical sectors for a continent facing climate change. Startups are innovating in solar energy, pay-as-you-go models, supply chain tech, and precision farming.

-

E-commerce & Logistics: Solving the “last-mile” challenge in fragmented markets. Companies are building logistics networks, marketplaces, and enabling technologies for cross-border trade.

-

Healthtech: Leveraging telemedicine, drug delivery, and diagnostic tech to bridge healthcare access gaps.

-

Enterprise SaaS: A growing sector addressing the digitalization needs of Africa’s burgeoning formal businesses.

Part II: The Venture Capital Ecosystem – Fueling the Fire

Evolution and Current State

The African VC journey began in the early 2010s with pioneer funds and angel investors. The landmark exit of Paystack to Stripe for over $200 million in 2020 served as a continental proof-of-concept, dramatically accelerating international investor interest.

Funding Landscape (2021-2023):

-

Record Growth: African startups raised over $5 billion in 2021 and 2022, though 2023 saw a global pullback and a correction to ~$3.5 billion, aligning with worldwide trends.

-

Increased Sophistication: There’s a visible shift from early-stage seed rounds to larger Series B and C rounds, indicating maturing companies. “Mega-rounds” ($100M+) are no longer rare.

-

Investor Mix: The ecosystem is powered by a blend of:

-

Local & Pan-African VCs: Partech Africa, Norrsken22, TLcom Capital, Ventures Platform.

-

Global VCs: Sequoia Capital, Tiger Global, Andreessen Horowitz (a16z).

-

Corporate Ventures: Google, Meta, Microsoft, and telecom giants like MTN and Orange.

-

Development Finance Institutions (DFIs) & Impact Investors: IFC, CDC Group, Proparco. These are often cornerstone limited partners (LPs) in African VC funds, providing crucial risk capital.

-

The Multifaceted Role of the Modern African VC

Beyond providing capital, the most successful VCs in Africa play a deeply embedded, value-add role:

-

Operator-Investors: Many firms are staffed with partners who have founded companies or have deep operational experience. They assist with go-to-market strategy, hiring, and technical architecture.

-

Talent Catalysts: They help founders build executive teams, connect with global talent, and implement governance structures—a key ingredient for scaling.

-

Cross-Border Expansion Guides: Helping a Nigerian startup expand to Kenya or Egypt requires nuanced understanding of regulatory, cultural, and market differences. VCs provide this network and expertise.

-

Governance Architects: Introducing professional financial reporting, board management, and compliance frameworks to prepare startups for later-stage investment and exits.

-

Ecosystem Builders: Leading VCs often initiate or support incubators, founder communities, and policy advocacy groups, strengthening the entire infrastructure.

Part III: Critical Challenges and Structural Hurdles

Despite the progress, significant challenges persist:

-

The “Pioneer Gap” / “Missing Middle”: While seed funding has grown, there remains a scarcity of Series A/B capital ($2M – $15M). Many startups that successfully validate their concept struggle to secure the growth capital needed to scale.

-

Exit Environment: The path to liquidity (exits) is still being proven. While acquisitions by international strategics (like Stripe/Paystack, Visa/Earthport) and intra-African consolidations are increasing, large-scale IPOs on local exchanges are rare. This affects VC fund returns and recycling of capital.

-

Currency & Macroeconomic Volatility: Operating across 54 countries with varying currencies, inflation rates, and capital controls adds immense complexity for startups and investors alike.

-

Regulatory Fragmentation: Each market has its own, often evolving, regulations for digital services, data privacy, and financial technology, complicating pan-African scaling.

-

Talent War: Intense competition for experienced senior engineers, product managers, and growth marketers drives up costs and can limit scaling speed.

Part IV: The Road Ahead – Trends and Predictions

-

Increased Specialization: Expect more sector-focused funds (e.g., climate tech, healthtech) and geographically specialized funds as the ecosystem matures.

-

Local LP Growth: The rise of African institutional investors (pension funds, insurance companies) as LPs in VC funds is critical for long-term, sustainable capital.

-

Corporate M&A as a Primary Exit Path: Strategic acquisitions by both global tech firms and large African corporates seeking digital transformation will likely dominate exit activity in the medium term.

-

Deeper Tech Adoption: Startups will increasingly leverage AI, blockchain, and IoT to build more defensible moats and complex solutions.

-

Policy as an Enabler: Governments that create transparent, innovation-friendly regulations (like Nigeria’s startup act and Kenya’s sandbox approaches) will attract disproportionate capital and talent.

Conclusion: A Symbiotic Ascent

The trajectory of Africa’s startup ecosystem is inextricably linked to the maturation of its venture capital industry. They are engaged in a symbiotic ascent: as startups demonstrate more scalable success, they attract more sophisticated capital; as more capital becomes available, it enables startups to tackle larger problems and achieve greater scale.

The role of the VC has evolved from being a mere financier to a co-pilot, ecosystem architect, and talent magnet. While challenges like the “missing middle” of funding and exit pathways remain, the directional momentum is undeniable. Africa is not just importing technology business models; it is exporting innovative solutions born from its unique constraints and opportunities. The continent’s startup landscape, powered by an increasingly astute class of venture capitalists, is not merely participating in the global tech story—it is poised to author some of its most compelling and impactful chapters in the decade to come.

Sources: Africa: The Big Deal (Funding Database), Briter Bridges, AVCA (African Private Capital Association) reports, McKinsey & Company, The Baobab Network, and analyses from leading African VCs like Partech Africa and Future Africa.